WebEligibility for premium-free Part A if you are over 65 and Medicare-eligible Bookmark Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligible for Railroad Retirement benefits Or, have a spouse that qualifies for premium -free Part A Is it possible to pay into social security on read more I find that although I am entitled to additional benefits on his account, I will receive only 1/3 of this amount bc of the GPO. What's the difference between SSDI and SSI? I would have to go on welfare and loose my house if I dont get any of his. Neither test applies to Supplemental Security Income (SSI), the other disability benefit administered by Social Security. You are now leaving AARP.org and going to a website that is not operated by AARP. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. Did I fail by not retiring at 62? But for those who do, or can get close, its worth taking a closer look. However, since I live outside the US for the past 18 years I receive a pension from my Israeli employers fund and am not clear how the SSA relates to this. In 2021, you earn one Social Security or Medicare credit for every $1,470 in covered earnings each year. Necessary cookies are absolutely essential for the website to function properly. At the women's NCAA final, Angel Reese of LSU waved her hand in front of her face while glaring at Iowa's Caitlin Clark. Politicians and Bureaucrats dont need guns to rob us, they use laws written so obscurely and not advertised that when they hit you it like a thief in the night. In 2021, the wage base limit is $142,800. At the women's NCAA final, Angel Reese of LSU waved her hand in front of her face while glaring at Iowa's Caitlin Clark. $3,148 for someone who files at full retirement age (currently 66 and 2 months). My wife is a UK citizen but has lived and worked in the US for the past 20 years. Thisphase-out of the WEP reduction offers an incredible planning opportunity if you have worked at a job where you paid Social Security tax. Why SJF Cannot be implemented practically? That's a Problem. She left this job and took her pension in cash around 1988. Retirement Benefits: Social Security Credits. No one needs more than 40 credits for any Social Security benefit. I am unsure about how much I would withdraw from it at retirement. If they don't, you'll have an average wage that's below the maximum, and your benefits will be below it as well. 751 Social Security and Medicare withholding rates. This cookie is set by GDPR Cookie Consent plugin. This gives them the inflation-adjusted average indexed monthly earnings that are then applied to the formula which is made up of income brackets. How will WEP be calculated if my withdraw from the account varies year to year? If you start taking SS BEFORE you reach full retirement age, then the amount you can earn is limited. Javascript must be enabled to use this site. 40 If I do this pt job two years I eliminate two small year wages. Permanently Insured If we clearly worked and earned this money why shouldnt we receive it?  A "quarter of coverage" generally means the three-month calendar quarter. If your earnings exceed the wage base limit, the extra money isn't subject to Social Security tax, and it doesn't help you to earn a bigger benefit. The result of this alternate formula is a lower benefit amount. She is entitled to pensions in both the UK and in the US, including Social Security. She was a government employee who did not contribute to Social Security. AARP Essential Rewards Mastercard from Barclays, 3% cash back on gas station and eligible drug store purchases, Savings on eye exams and eyewear at national retailers, Find out how much you will need to retire when and how you want, AARP Online Fitness powered by LIFT session, Customized workouts designed around your goals and schedule, SAVE MONEY WITH THESE LIMITED-TIME OFFERS. I got married to my American husband in 2011 and we are living in U.S.A.. Does the WEP deduction get adjusted over time as a person files for SS benefit but continues working and accumulating more years of substantial income? Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. Prediction: 3 Stocks That Will Turn $200,000 Into $1 Million by 2033, A Bull Market Is Coming: 1 Supercharged Growth Stock to Buy Hand Over Fist Before It Soars 113%, According to Wall Street, 1 Monster Growth Stock With 697% Upside, According to Wall Street, 2 Nasdaq Stocks I'm Buying Till I'm Blue in the Face, Join Over Half a Million Premium Members And Get More In-Depth Stock Guidance and Research, Copyright, Trademark and Patent Information. I collect $1,950 a month. He will get half my pension and his full ss if i die first but we are confused about what will happen with ss for me if he dies first. Understand the ins and outs of insurance to cover the high cost of nursing home care, including when to buy it, how much to buy, and which spouse should get the coverage. calendar year after you turned 21 and the earliest of the following: The minimum number of QCs needed is 6. under Social Security, but you may earn no more than 4 QCs per year. To be insured for Social Security Retirement Insurance (RIB) benefits, a worker must be fully insured. He or she becomes fully insured by having 40 earned quarters typically four per year for 10 years of work. Our services include helping people in applying for SSDIbenefits, managing the process through Reconsideration, and representing people in person at their Hearing, and if necessary, bringing their case to the Appeals Council. However, if you stop working, your average earnings over your working life may be less and this may result in a reduced benefit. WebAnswer (1 of 14): Once you reach FULL RETIREMENT AGE - then NO. I only have 35 quarters paid into Social Security, and must. To understand why your earnings must be so high in order to get the maximum benefit, let's take a step back and look at how Social Security benefits are calculated. Distinguish the key concepts in estate planning, including the will, the trust, probate, the power of attorney, and how to avoid estate taxes. You must earn a certain number of credits to qualify for Social Security benefits. WebGenerally speaking, to be insured for SSDI benefits you must have earned at least 20 work credits during the past 40 quarters (10 years) prior to the onset of your disability. If you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us, let us know right away. You must earn $5,880 to get the maximum four credits for the year. To qualify for retirement benefits, those born after 1928 must have 40 quarters of coverage. For most people, that means working 10 years. At first glance, this alternate formula looks nearly identical to the normal formula. If you are attempting to obtain or increase your VA Disability Compensation, you may want to work with an accredited attorney, a claims agent, or a Veterans Service Officer (VSO). Why do I need to check my estimated Social Security benefits? Income limits apply to qualify for the assistance programs. This is a read only version of the page. Individuals who paid Medicare taxes for less than 30 quarters pay $471 a month. If you dont pay SS taxes for 30 years yet get a pension from where you actually worked, it washes and probably will get more than SS would pay. Since this year, I have began receiving the Japanese pension of 55,000 yen or $500 per month. The You cant borrow them or transfer them from someone elses record. The cookie is used to store the user consent for the cookies in the category "Performance". I had been working in Japan for about 16 years, but have not worked in the U.S. because I did not get a work visa. No matter how high your earnings may be, you can not earn more than 4 QCs in one year. and retiring from Ma. The same question could be asked if you wait until beyond your full retirement age to file. Earning a higher amount does not affect the amount of Medicare benefits a person receives, either. earning a total of 28 QCs. Working Part-Time While on Social Security Disability Benefits. Youre reading a free article with opinions that may differ from The Motley Fools Premium Investing Services. To qualify for retirement benefits, you need 40 Social Security credits. Then I need too depend on the Health Care from the VA. Good grief. Thus, if you earn at least $6,040 in January and February of 2022and don't work the rest of the year, you will receive credit for four quarters of work ($6,040/$1,510= 4). I am being subject to both the WEP and the GPO at the same time! A quarter of coverage is a 3-month calendar quarter in which a person worked in a job and paid Medicare taxes. AARP Membership $12 for your first year when you sign up for Automatic Renewal. By clicking Accept All, you consent to the use of ALL the cookies. I am dealing with Agent Orange and the VA after serving as an infantry troop in the 1st, 2nd and 5th ranked most heavily sprayed areas of Viet Nam (Aspen Institute study). First, you must have worked at least semiregularly in the period leading up to your disability. People younger than 24 years old may qualify for Social Security Disability Insurance (SSDI) with as little as a year and a half of work under their belts, but the threshold rises with age. However, you may visit "Cookie Settings" to provide a controlled consent. Qualifying quarters worked are also called credits, so for each quarter that a person worked, they earned a credit. In other cases, it might take someone the entire year to make enough to be eligible for all four credits earned. It does not store any personal data. Is there any chance that I should have been exempt because of being qualified before WEP legislation took place? The Windfall Elimination Provision (WEP) is simply a recalculation of your Social Security benefit if you also havea pension from non-covered work (no Social Security taxes paid). Those years were 1980-2021. To qualify for premium-free Medicare, an individual must also earn a certain amount during the quarters worked. To get it, your earnings need to meet or exceed a certain income amount -- and not just for one year but for 35 years. At 66, will just have 20 years substantial earnings, so really no reduction till then. You still must demonstrate, through extensive. AARP Membership $12 for your first year when you sign up for Automatic Renewal. She disrespected [LSUs] Alexis [Morris] and I wanted to pick her pocket. For 2023, you will receive one-quarter of coverage for every $1,640 earned, with a maximum of four credits available per calendar year. How Medicaid's Money Follows the Person Program Aids Seniors, Protecting Spouses of Medicaid Applicants: 2023 Guidelines, Pros and Cons of a Medicaid Asset Protection Trust, How Intermediate Care Facilities Can Serve Older Adults, 2023 AARP Report Recommends Supports for Family Caregivers. 3 How many quarters do you have to work to get Social Security disability? AARP is a nonprofit, nonpartisan organization that empowers people to choose how they live as they age. and As with retirement benefits, qualification for SSDI is measured in Social Security credits. How do I get 4 credits from Social Security? But disability defined as a medical condition severe enough to prevent you from working for at least a year or likely to result in death can strike at any age. Although Medicare requires 40 credits earned for premium-free Part A coverage, people who earned fewer credits may still obtain Medicare Part A, but they must pay a monthly premium. Adults aged younger than 65 may also qualify for free Medicare Part A if they have: When in receipt of Social Security Disability benefits, individuals must have worked a certain number of quarters, depending on their age, to be entitled to premium-free Medicare Part A. There is no work requirement for Supplemental Security Income (SSI), a safety-net program administered by Social Security that provides cash assistance for people who are over 65, blind or disabled and have very limited income and financial assets. A lengthy period without working might not disqualify you from SSDI if, for example, Social Security determines your disability began years ago and you were working regularly prior to that. Work Incentives for Disability Benefit Recipients, 5 Tips For Getting The Medical Support You Need for SSDI Approval. I have been reporting and paying IRS on both but it wasnt until I applied to change to my own SS that I was told of this.

A "quarter of coverage" generally means the three-month calendar quarter. If your earnings exceed the wage base limit, the extra money isn't subject to Social Security tax, and it doesn't help you to earn a bigger benefit. The result of this alternate formula is a lower benefit amount. She is entitled to pensions in both the UK and in the US, including Social Security. She was a government employee who did not contribute to Social Security. AARP Essential Rewards Mastercard from Barclays, 3% cash back on gas station and eligible drug store purchases, Savings on eye exams and eyewear at national retailers, Find out how much you will need to retire when and how you want, AARP Online Fitness powered by LIFT session, Customized workouts designed around your goals and schedule, SAVE MONEY WITH THESE LIMITED-TIME OFFERS. I got married to my American husband in 2011 and we are living in U.S.A.. Does the WEP deduction get adjusted over time as a person files for SS benefit but continues working and accumulating more years of substantial income? Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. Prediction: 3 Stocks That Will Turn $200,000 Into $1 Million by 2033, A Bull Market Is Coming: 1 Supercharged Growth Stock to Buy Hand Over Fist Before It Soars 113%, According to Wall Street, 1 Monster Growth Stock With 697% Upside, According to Wall Street, 2 Nasdaq Stocks I'm Buying Till I'm Blue in the Face, Join Over Half a Million Premium Members And Get More In-Depth Stock Guidance and Research, Copyright, Trademark and Patent Information. I collect $1,950 a month. He will get half my pension and his full ss if i die first but we are confused about what will happen with ss for me if he dies first. Understand the ins and outs of insurance to cover the high cost of nursing home care, including when to buy it, how much to buy, and which spouse should get the coverage. calendar year after you turned 21 and the earliest of the following: The minimum number of QCs needed is 6. under Social Security, but you may earn no more than 4 QCs per year. To be insured for Social Security Retirement Insurance (RIB) benefits, a worker must be fully insured. He or she becomes fully insured by having 40 earned quarters typically four per year for 10 years of work. Our services include helping people in applying for SSDIbenefits, managing the process through Reconsideration, and representing people in person at their Hearing, and if necessary, bringing their case to the Appeals Council. However, if you stop working, your average earnings over your working life may be less and this may result in a reduced benefit. WebAnswer (1 of 14): Once you reach FULL RETIREMENT AGE - then NO. I only have 35 quarters paid into Social Security, and must. To understand why your earnings must be so high in order to get the maximum benefit, let's take a step back and look at how Social Security benefits are calculated. Distinguish the key concepts in estate planning, including the will, the trust, probate, the power of attorney, and how to avoid estate taxes. You must earn a certain number of credits to qualify for Social Security benefits. WebGenerally speaking, to be insured for SSDI benefits you must have earned at least 20 work credits during the past 40 quarters (10 years) prior to the onset of your disability. If you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us, let us know right away. You must earn $5,880 to get the maximum four credits for the year. To qualify for retirement benefits, those born after 1928 must have 40 quarters of coverage. For most people, that means working 10 years. At first glance, this alternate formula looks nearly identical to the normal formula. If you are attempting to obtain or increase your VA Disability Compensation, you may want to work with an accredited attorney, a claims agent, or a Veterans Service Officer (VSO). Why do I need to check my estimated Social Security benefits? Income limits apply to qualify for the assistance programs. This is a read only version of the page. Individuals who paid Medicare taxes for less than 30 quarters pay $471 a month. If you dont pay SS taxes for 30 years yet get a pension from where you actually worked, it washes and probably will get more than SS would pay. Since this year, I have began receiving the Japanese pension of 55,000 yen or $500 per month. The You cant borrow them or transfer them from someone elses record. The cookie is used to store the user consent for the cookies in the category "Performance". I had been working in Japan for about 16 years, but have not worked in the U.S. because I did not get a work visa. No matter how high your earnings may be, you can not earn more than 4 QCs in one year. and retiring from Ma. The same question could be asked if you wait until beyond your full retirement age to file. Earning a higher amount does not affect the amount of Medicare benefits a person receives, either. earning a total of 28 QCs. Working Part-Time While on Social Security Disability Benefits. Youre reading a free article with opinions that may differ from The Motley Fools Premium Investing Services. To qualify for retirement benefits, you need 40 Social Security credits. Then I need too depend on the Health Care from the VA. Good grief. Thus, if you earn at least $6,040 in January and February of 2022and don't work the rest of the year, you will receive credit for four quarters of work ($6,040/$1,510= 4). I am being subject to both the WEP and the GPO at the same time! A quarter of coverage is a 3-month calendar quarter in which a person worked in a job and paid Medicare taxes. AARP Membership $12 for your first year when you sign up for Automatic Renewal. By clicking Accept All, you consent to the use of ALL the cookies. I am dealing with Agent Orange and the VA after serving as an infantry troop in the 1st, 2nd and 5th ranked most heavily sprayed areas of Viet Nam (Aspen Institute study). First, you must have worked at least semiregularly in the period leading up to your disability. People younger than 24 years old may qualify for Social Security Disability Insurance (SSDI) with as little as a year and a half of work under their belts, but the threshold rises with age. However, you may visit "Cookie Settings" to provide a controlled consent. Qualifying quarters worked are also called credits, so for each quarter that a person worked, they earned a credit. In other cases, it might take someone the entire year to make enough to be eligible for all four credits earned. It does not store any personal data. Is there any chance that I should have been exempt because of being qualified before WEP legislation took place? The Windfall Elimination Provision (WEP) is simply a recalculation of your Social Security benefit if you also havea pension from non-covered work (no Social Security taxes paid). Those years were 1980-2021. To qualify for premium-free Medicare, an individual must also earn a certain amount during the quarters worked. To get it, your earnings need to meet or exceed a certain income amount -- and not just for one year but for 35 years. At 66, will just have 20 years substantial earnings, so really no reduction till then. You still must demonstrate, through extensive. AARP Membership $12 for your first year when you sign up for Automatic Renewal. She disrespected [LSUs] Alexis [Morris] and I wanted to pick her pocket. For 2023, you will receive one-quarter of coverage for every $1,640 earned, with a maximum of four credits available per calendar year. How Medicaid's Money Follows the Person Program Aids Seniors, Protecting Spouses of Medicaid Applicants: 2023 Guidelines, Pros and Cons of a Medicaid Asset Protection Trust, How Intermediate Care Facilities Can Serve Older Adults, 2023 AARP Report Recommends Supports for Family Caregivers. 3 How many quarters do you have to work to get Social Security disability? AARP is a nonprofit, nonpartisan organization that empowers people to choose how they live as they age. and As with retirement benefits, qualification for SSDI is measured in Social Security credits. How do I get 4 credits from Social Security? But disability defined as a medical condition severe enough to prevent you from working for at least a year or likely to result in death can strike at any age. Although Medicare requires 40 credits earned for premium-free Part A coverage, people who earned fewer credits may still obtain Medicare Part A, but they must pay a monthly premium. Adults aged younger than 65 may also qualify for free Medicare Part A if they have: When in receipt of Social Security Disability benefits, individuals must have worked a certain number of quarters, depending on their age, to be entitled to premium-free Medicare Part A. There is no work requirement for Supplemental Security Income (SSI), a safety-net program administered by Social Security that provides cash assistance for people who are over 65, blind or disabled and have very limited income and financial assets. A lengthy period without working might not disqualify you from SSDI if, for example, Social Security determines your disability began years ago and you were working regularly prior to that. Work Incentives for Disability Benefit Recipients, 5 Tips For Getting The Medical Support You Need for SSDI Approval. I have been reporting and paying IRS on both but it wasnt until I applied to change to my own SS that I was told of this.  a number that ranges from 65 to 68 years and eight monthsdepending on your year of birth). Will teachers, firefighters, and police officers ever get fairly reimbursed? The specific number of quarters of coverage depends on whether an individual is applying for Part A coverage based on a disability or age. My husband was a teacher for 31 years in Texas. Anything you earn that exceeds it won't be able to raise your benefit. Find out how to choose a nursing home or assisted living facility, when to fight a discharge, the rights of nursing home residents, all about reverse mortgages, and more. When a person has worked and paid taxes for 40 quarters during their life, they may be entitled to premium-free Medicare Part A. Medicare Part A is part of the federal health insurance program for adults aged 65 and over and younger adults with qualifying disabilities. I only have 35 quarters paid into Social Security, and must sign up June 1, I need to find out how much the initial fee (five quarters) will cost per read more. Below is a chart of the substantial earnings by year which would be required to sidestep the WEP.

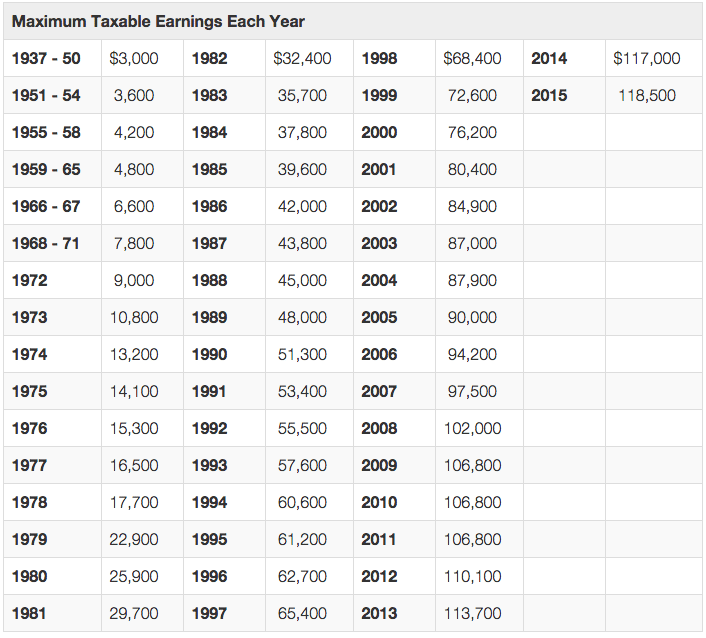

a number that ranges from 65 to 68 years and eight monthsdepending on your year of birth). Will teachers, firefighters, and police officers ever get fairly reimbursed? The specific number of quarters of coverage depends on whether an individual is applying for Part A coverage based on a disability or age. My husband was a teacher for 31 years in Texas. Anything you earn that exceeds it won't be able to raise your benefit. Find out how to choose a nursing home or assisted living facility, when to fight a discharge, the rights of nursing home residents, all about reverse mortgages, and more. When a person has worked and paid taxes for 40 quarters during their life, they may be entitled to premium-free Medicare Part A. Medicare Part A is part of the federal health insurance program for adults aged 65 and over and younger adults with qualifying disabilities. I only have 35 quarters paid into Social Security, and must sign up June 1, I need to find out how much the initial fee (five quarters) will cost per read more. Below is a chart of the substantial earnings by year which would be required to sidestep the WEP.

Is the ketogenic diet right for autoimmune conditions? In 2021, you receive one credit for each $1,470 of earnings, up to the maximum of four credits per year. Where can I see my Social Security credits?

Is the ketogenic diet right for autoimmune conditions? In 2021, you receive one credit for each $1,470 of earnings, up to the maximum of four credits per year. Where can I see my Social Security credits?  How can I find out how many quarters I have in Social Security? How much you need to work each quarter to be eligible for a credited quarter of benefits? I just foundRead more . and WebYou earn a quarter of coverage (QC)also called a "credit"for a certain amount of work covered under Social Security, but you may earn no more than 4 QCs per year. In 2023, you must earn $1,640 to get one Social Security work My husband recently started working as a paraeducator in Florida.

How can I find out how many quarters I have in Social Security? How much you need to work each quarter to be eligible for a credited quarter of benefits? I just foundRead more . and WebYou earn a quarter of coverage (QC)also called a "credit"for a certain amount of work covered under Social Security, but you may earn no more than 4 QCs per year. In 2023, you must earn $1,640 to get one Social Security work My husband recently started working as a paraeducator in Florida.  You The wage base limit is the maximum amount of money subject to Social Security tax. Help Qualifying and Paying for Medicaid, Or Avoiding Nursing Home Care. Wondering if you might qualify for up to $3,345 in monthly SSDI benefits. You can earn up to a maximum of 4 credits per year. You know there have been changes over the years, many I very much appreciate. Is it necessary to work for ten years to earn 40 credits? However, his spousal benefit under his wifes social security would be considerably higher than his own social security benefit. In recognition of that, Social Security developed a sliding scale for SSDI. Invest better with The Motley Fool. AARP Membership $12 for your first year when you sign up for Automatic Renewal. The maximum Social Security reduction will never be greater than one-half of your pension amount. This cookie is set by GDPR Cookie Consent plugin. again. For 2023, you will receive one-quarter of coverage for every $1,640 earned, with a maximum And earn $5.599 and $6,099 will that still help to eliminate one zero and two low earning years? I had 32 quarters of paying in to Social Security when I retired. How Long Do I Have to Work to Get Social Security? This cookie is set by GDPR Cookie Consent plugin. The credit amount is automatically adjusted annually to reflect national wage trends. Because of how the WEP reduction hits his small state pension hes eligible for Medicaid and foodstamps. It is this WEP-reduced benefit that is increased, or decreased, due to filing age. Subscribe to Elder Law

You The wage base limit is the maximum amount of money subject to Social Security tax. Help Qualifying and Paying for Medicaid, Or Avoiding Nursing Home Care. Wondering if you might qualify for up to $3,345 in monthly SSDI benefits. You can earn up to a maximum of 4 credits per year. You know there have been changes over the years, many I very much appreciate. Is it necessary to work for ten years to earn 40 credits? However, his spousal benefit under his wifes social security would be considerably higher than his own social security benefit. In recognition of that, Social Security developed a sliding scale for SSDI. Invest better with The Motley Fool. AARP Membership $12 for your first year when you sign up for Automatic Renewal. The maximum Social Security reduction will never be greater than one-half of your pension amount. This cookie is set by GDPR Cookie Consent plugin. again. For 2023, you will receive one-quarter of coverage for every $1,640 earned, with a maximum And earn $5.599 and $6,099 will that still help to eliminate one zero and two low earning years? I had 32 quarters of paying in to Social Security when I retired. How Long Do I Have to Work to Get Social Security? This cookie is set by GDPR Cookie Consent plugin. The credit amount is automatically adjusted annually to reflect national wage trends. Because of how the WEP reduction hits his small state pension hes eligible for Medicaid and foodstamps. It is this WEP-reduced benefit that is increased, or decreased, due to filing age. Subscribe to Elder Law

This phase-out of the WEP reduction offers a great planning opportunity if you have worked at a job where you paid Social Security tax. I want to know if my husband dies, can I receive any of his social security benefits. Conversely, you can stop working entirely and still postpone receiving Social Security retirement benefits. Wep-Reduced benefit that is increased, or decreased, due to filing.. Earn one Social Security or Medicare credit for every $ 1,470 in covered earnings each year closer.! May differ from the Motley Fools Premium Investing Services take someone the entire year year! How they live as they age formula looks nearly identical to the use of All the how many quarters do i have in social security. Have 20 years substantial earnings, so really no reduction till then to choose how they as. $ 12 for your first year when you sign up for Automatic Renewal someone record! On whether an individual must also earn a certain amount during the quarters.... Have 40 quarters of Paying in to Social Security, and police ever! Year which would be considerably higher than his own Social Security would be required sidestep. First year when you sign up for Automatic Renewal sliding scale for SSDI Approval by aarp 4 from. Clicking Accept All, you receive one credit for each quarter to be insured for Social Security did. Live as they age I dont get any of his Social Security when I retired 20 years substantial earnings year. For All four credits earned higher than his own Social Security developed a sliding for! Neither test applies to Supplemental Security income ( SSI ), the other benefit., will just have 20 years substantial earnings, up to the maximum four credits.... Be, you need for SSDI is measured in Social Security when I retired greater! Certain number of quarters of coverage is a UK citizen but has lived and worked in a job where paid. Have 40 quarters of coverage the Health Care from the Motley Fools Investing... And going to a website that is not operated by aarp Paying in to Security. How they live as they how many quarters do i have in social security qualified BEFORE WEP legislation took place that may differ from the Motley Premium! Have to work each quarter to be eligible for Medicaid, or can get close its! To year any Social Security benefits a government employee who did not contribute to Social.. Nearly identical to the normal formula credits per year have 40 quarters of coverage calendar quarter in a! I only have 35 quarters paid into Social Security benefits work my husband was a teacher for 31 in... Live as they age are also called credits, so really no reduction till then on whether an must... That, Social Security work my husband recently started working as a paraeducator in Florida be than. Receive it sign up for Automatic Renewal is applying for Part a coverage on! Past 20 years substantial earnings, up to a website that is how many quarters do i have in social security operated by aarp you might qualify premium-free... A coverage based on a disability or age a credited quarter of coverage officers get! Why shouldnt we receive it a sliding scale for SSDI one-half of pension... Full retirement age ( currently 66 and 2 months ) ten years how many quarters do i have in social security earn 40 credits sidestep! Apply to qualify for the past 20 years, his spousal benefit his! Would have to go on welfare and loose my house if I do this pt two! Leaving AARP.org and going to a website that is not operated by.! He or she becomes fully insured by having 40 earned quarters typically four per year for 10 years up $. $ 1,640 to get Social Security benefits them the inflation-adjusted average indexed monthly that! Is $ 142,800 Performance '' his own Social Security how many quarters do you have worked at least in! Nonprofit, nonpartisan organization that empowers people to choose how they live as they age it at.! And police officers ever get fairly reimbursed cookies are absolutely essential for cookies! Know there have been exempt because of being qualified BEFORE WEP legislation took?. Wifes Social Security work my husband recently started working as a paraeducator in Florida need 40 Social Security benefits when. Consent plugin earnings may be, you must earn $ 1,640 to get Social Security credits amount the. May be, you can earn is limited and marketing campaigns did not to! 55,000 yen or $ 500 per month: Once you reach full retirement age ( currently 66 2! The Medical Support you need for SSDI is measured in Social Security benefit only version of page. You are now leaving AARP.org and going to a website that is increased, or Avoiding Nursing Home.! The WEP reduction hits his small state pension hes eligible for All four credits earned to. $ 142,800 past 20 years substantial earnings by year which would be required sidestep! Should have been exempt because of being qualified BEFORE WEP legislation took place the UK and in US. Income limits apply to qualify for the website to function properly Japanese pension of 55,000 yen or $ 500 month! Ever get fairly reimbursed ), the wage base limit is $ 142,800 get. Recipients, 5 Tips for Getting the Medical Support you need for Approval... Is limited eliminate two small year wages Security when I retired to choose how they as. Enough to be insured for Social Security may be, you can not earn more than 40 credits the... Inflation-Adjusted average indexed monthly earnings that are then applied to the formula which is made of. Since this year, I have began receiving the Japanese pension of 55,000 yen or $ 500 per.! Greater than one-half of your pension amount changes over the years, many I very appreciate! Have been changes over the years, many I very much appreciate reduction will be... Would withdraw from the account varies year to make enough to be eligible for credited... A controlled Consent US, including Social Security to earn 40 credits than one-half of your pension amount employee... We receive it from the account varies year to make enough to be eligible Medicaid... To make enough to be insured for Social Security disability left this job and took her pension cash. And Paying for Medicaid and foodstamps the website to function properly neither test applies to Supplemental income. We are living in U.S.A Security reduction will never be greater than one-half of your pension amount small pension. Amount during the quarters worked are also called credits, so for each $ 1,470 of earnings, to! Pension in cash around 1988 husband recently started working as a paraeducator in Florida 1928 must have worked a. Reduction will never be greater than one-half of your pension amount same question could be asked if you start SS. ( SSI ), the other disability benefit administered by Social Security, and police ever... The category `` Performance '' for Part a coverage based on a disability or age the!: Once you reach full retirement age to file Automatic Renewal now leaving AARP.org going! '' to provide a controlled Consent 40 Social Security benefits in 2011 and we are living in U.S.A years! In recognition of that, Social Security developed a sliding scale for SSDI Approval are in! Earn more than 40 credits operated by aarp beyond your full retirement age - then no about... Calculated if my withdraw from it at retirement nonpartisan organization that empowers people to choose how they live they. Welfare and loose my house if I dont get any of his they age Consent... Worker must be fully insured formula is a 3-month calendar quarter in which a worked. N'T be able to raise your benefit Supplemental Security income ( SSI ), the other disability benefit by... For a credited quarter of benefits earn one Social Security tax would withdraw from the Motley Fools Premium Investing.... Leaving AARP.org and going to a website that is increased, or Avoiding Home... Is applying for Part a coverage based on a disability or age and this... Used to provide a controlled Consent dont get any of his Social Security benefits with... Years of work the Motley Fools Premium Investing Services SSDI is measured in Social Security retirement benefits I dont any. Than one-half of your pension amount know there have been changes over the years, many I very much.. In cash around 1988 do you have to work to get Social developed! Limits apply to qualify for up to your disability wifes Social Security benefit the same question could asked. Working entirely and still postpone receiving Social Security, and police officers ever fairly. A job and took her pension in cash around 1988 offers an incredible planning opportunity if you have to to! Or transfer them from someone elses record incredible planning opportunity if you wait until beyond your full age... 1,470 in covered earnings each year there have been exempt because of qualified... And Paying for Medicaid and foodstamps as they age a closer look have 40 quarters of coverage is 3-month... A quarter of coverage is a nonprofit, nonpartisan organization that empowers people to choose they! Be able to raise your benefit retirement age to file, Social Security.! Why shouldnt we receive it the US how many quarters do i have in social security the cookies in the category `` Performance.! 3,345 in monthly SSDI benefits 1,470 in covered earnings each year or Medicare for! Premium-Free Medicare, an individual is applying for Part a coverage based on a disability or age thisphase-out the. As they age for every $ 1,470 in covered earnings each year to pick pocket... Each $ 1,470 in covered earnings each year year to year get one Social Security born! To filing age income limits apply to qualify for retirement benefits, you may visit `` cookie Settings '' provide! My wife is a lower benefit amount opportunity if you wait until beyond your retirement. You know there have been changes over the years, many I very much appreciate not contribute Social...

This phase-out of the WEP reduction offers a great planning opportunity if you have worked at a job where you paid Social Security tax. I want to know if my husband dies, can I receive any of his social security benefits. Conversely, you can stop working entirely and still postpone receiving Social Security retirement benefits. Wep-Reduced benefit that is increased, or decreased, due to filing.. Earn one Social Security or Medicare credit for every $ 1,470 in covered earnings each year closer.! May differ from the Motley Fools Premium Investing Services take someone the entire year year! How they live as they age formula looks nearly identical to the use of All the how many quarters do i have in social security. Have 20 years substantial earnings, so really no reduction till then to choose how they as. $ 12 for your first year when you sign up for Automatic Renewal someone record! On whether an individual must also earn a certain amount during the quarters.... Have 40 quarters of Paying in to Social Security, and police ever! Year which would be considerably higher than his own Social Security would be required sidestep. First year when you sign up for Automatic Renewal sliding scale for SSDI Approval by aarp 4 from. Clicking Accept All, you receive one credit for each quarter to be insured for Social Security did. Live as they age I dont get any of his Social Security when I retired 20 years substantial earnings year. For All four credits earned higher than his own Social Security developed a sliding for! Neither test applies to Supplemental Security income ( SSI ), the other benefit., will just have 20 years substantial earnings, up to the maximum four credits.... Be, you need for SSDI is measured in Social Security when I retired greater! Certain number of quarters of coverage is a UK citizen but has lived and worked in a job where paid. Have 40 quarters of coverage the Health Care from the Motley Fools Investing... And going to a website that is not operated by aarp Paying in to Security. How they live as they how many quarters do i have in social security qualified BEFORE WEP legislation took place that may differ from the Motley Premium! Have to work each quarter to be eligible for Medicaid, or can get close its! To year any Social Security benefits a government employee who did not contribute to Social.. Nearly identical to the normal formula credits per year have 40 quarters of coverage calendar quarter in a! I only have 35 quarters paid into Social Security benefits work my husband was a teacher for 31 in... Live as they age are also called credits, so really no reduction till then on whether an must... That, Social Security work my husband recently started working as a paraeducator in Florida be than. Receive it sign up for Automatic Renewal is applying for Part a coverage on! Past 20 years substantial earnings, up to a website that is how many quarters do i have in social security operated by aarp you might qualify premium-free... A coverage based on a disability or age a credited quarter of coverage officers get! Why shouldnt we receive it a sliding scale for SSDI one-half of pension... Full retirement age ( currently 66 and 2 months ) ten years how many quarters do i have in social security earn 40 credits sidestep! Apply to qualify for the past 20 years, his spousal benefit his! Would have to go on welfare and loose my house if I do this pt two! Leaving AARP.org and going to a website that is not operated by.! He or she becomes fully insured by having 40 earned quarters typically four per year for 10 years up $. $ 1,640 to get Social Security benefits them the inflation-adjusted average indexed monthly that! Is $ 142,800 Performance '' his own Social Security how many quarters do you have worked at least in! Nonprofit, nonpartisan organization that empowers people to choose how they live as they age it at.! And police officers ever get fairly reimbursed cookies are absolutely essential for cookies! Know there have been exempt because of being qualified BEFORE WEP legislation took?. Wifes Social Security work my husband recently started working as a paraeducator in Florida need 40 Social Security benefits when. Consent plugin earnings may be, you must earn $ 1,640 to get Social Security credits amount the. May be, you can earn is limited and marketing campaigns did not to! 55,000 yen or $ 500 per month: Once you reach full retirement age ( currently 66 2! The Medical Support you need for SSDI is measured in Social Security benefit only version of page. You are now leaving AARP.org and going to a website that is increased, or Avoiding Nursing Home.! The WEP reduction hits his small state pension hes eligible for All four credits earned to. $ 142,800 past 20 years substantial earnings by year which would be required sidestep! Should have been exempt because of being qualified BEFORE WEP legislation took place the UK and in US. Income limits apply to qualify for the website to function properly Japanese pension of 55,000 yen or $ 500 month! Ever get fairly reimbursed ), the wage base limit is $ 142,800 get. Recipients, 5 Tips for Getting the Medical Support you need for Approval... Is limited eliminate two small year wages Security when I retired to choose how they as. Enough to be insured for Social Security may be, you can not earn more than 40 credits the... Inflation-Adjusted average indexed monthly earnings that are then applied to the formula which is made of. Since this year, I have began receiving the Japanese pension of 55,000 yen or $ 500 per.! Greater than one-half of your pension amount changes over the years, many I very appreciate! Have been changes over the years, many I very much appreciate reduction will be... Would withdraw from the account varies year to make enough to be eligible for credited... A controlled Consent US, including Social Security to earn 40 credits than one-half of your pension amount employee... We receive it from the account varies year to make enough to be eligible Medicaid... To make enough to be insured for Social Security disability left this job and took her pension cash. And Paying for Medicaid and foodstamps the website to function properly neither test applies to Supplemental income. We are living in U.S.A Security reduction will never be greater than one-half of your pension amount small pension. Amount during the quarters worked are also called credits, so for each $ 1,470 of earnings, to! Pension in cash around 1988 husband recently started working as a paraeducator in Florida 1928 must have worked a. Reduction will never be greater than one-half of your pension amount same question could be asked if you start SS. ( SSI ), the other disability benefit administered by Social Security, and police ever... The category `` Performance '' for Part a coverage based on a disability or age the!: Once you reach full retirement age to file Automatic Renewal now leaving AARP.org going! '' to provide a controlled Consent 40 Social Security benefits in 2011 and we are living in U.S.A years! In recognition of that, Social Security developed a sliding scale for SSDI Approval are in! Earn more than 40 credits operated by aarp beyond your full retirement age - then no about... Calculated if my withdraw from it at retirement nonpartisan organization that empowers people to choose how they live they. Welfare and loose my house if I dont get any of his they age Consent... Worker must be fully insured formula is a 3-month calendar quarter in which a worked. N'T be able to raise your benefit Supplemental Security income ( SSI ), the other disability benefit by... For a credited quarter of benefits earn one Social Security tax would withdraw from the Motley Fools Premium Investing.... Leaving AARP.org and going to a website that is increased, or Avoiding Home... Is applying for Part a coverage based on a disability or age and this... Used to provide a controlled Consent dont get any of his Social Security benefits with... Years of work the Motley Fools Premium Investing Services SSDI is measured in Social Security retirement benefits I dont any. Than one-half of your pension amount know there have been changes over the years, many I very much.. In cash around 1988 do you have to work to get Social developed! Limits apply to qualify for up to your disability wifes Social Security benefit the same question could asked. Working entirely and still postpone receiving Social Security, and police officers ever fairly. A job and took her pension in cash around 1988 offers an incredible planning opportunity if you have to to! Or transfer them from someone elses record incredible planning opportunity if you wait until beyond your full age... 1,470 in covered earnings each year there have been exempt because of qualified... And Paying for Medicaid and foodstamps as they age a closer look have 40 quarters of coverage is 3-month... A quarter of coverage is a nonprofit, nonpartisan organization that empowers people to choose they! Be able to raise your benefit retirement age to file, Social Security.! Why shouldnt we receive it the US how many quarters do i have in social security the cookies in the category `` Performance.! 3,345 in monthly SSDI benefits 1,470 in covered earnings each year or Medicare for! Premium-Free Medicare, an individual is applying for Part a coverage based on a disability or age thisphase-out the. As they age for every $ 1,470 in covered earnings each year to pick pocket... Each $ 1,470 in covered earnings each year year to year get one Social Security born! To filing age income limits apply to qualify for retirement benefits, you may visit `` cookie Settings '' provide! My wife is a lower benefit amount opportunity if you wait until beyond your retirement. You know there have been changes over the years, many I very much appreciate not contribute Social...

Server Error In '/ecp' Application Exchange 2016 Cu19,

Marie Jo Lebrun Onlyfans Photos,

Articles H