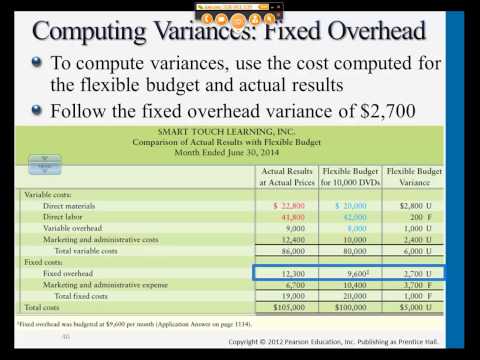

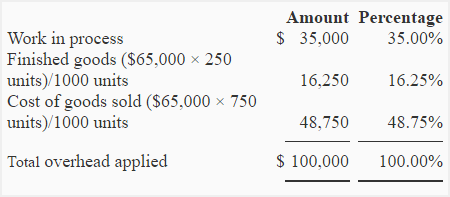

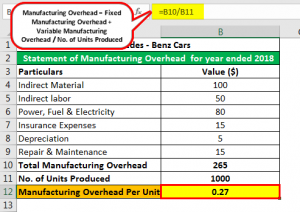

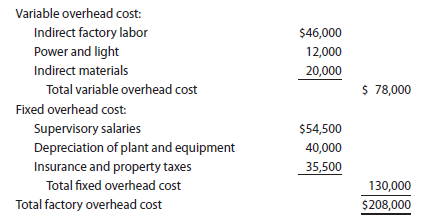

The journal entry to record the application of Manufacturing Overhead to Work in Process would include a: credit to Manufacturing Overhead of The Overhead Costs form an important part of the production process. If 16,000 units of materials enter production during the first year of operations, 12,000 of the units are finished, and 4,000 are 75% completed, the number of equivalent units of production would be 15,000. Terms and conditions, features, support, pricing, and service options subject to change without notice. This website uses cookies and third party services. When workers are paid on a piece basis, this method will not give satisfactory results because the time factor is ignored. An account used to hold financial data temporarily until it is closed out at the end of the period. This method does not distinguish between work done by skilled and unskilled workers, as unskilled workers take more time and thus give rise to more factory expense than skilled workers. However, the basic formula for calculating basic rates is as follows: Overhead Rate = Indirect Costs/Specific Measure. Each heading will be given an appropriate standing order number. It is most suitable where labour constitutes the major factor of production. The value of the inventory transferred to finished goods in the production cost report is the same as in the journal entry: Each unit is a package of two drumsticks that cost $8.40 to make and sells for $24.99. In such a situation it seems quite logical that the overheads of the transport department are charged to various production departments in proportion to the number of the potential users, regardless of the actual number of workers in each department. (e) According to production hours of direct labour. The most common allocation bases are direct labor hours, direct labor costs, and machine hours. These are also called Overhead Costs. period. This causes misleading results. Under this method service department overheads are charged to production departments on the basis of potential rather than actual services rendered. Learn about 1. But this basis cannot be used in all cases, e.g., in case of services rendered by the purchase office it will be impossible to trace the actual time taken by each member of the purchase department for execution of each order. For example, wages paid to the salespeople, travel expenses, etc. It is suitable when most of the work is done manually. iii. This criterion has the greatest applicability in cases where overheads costs can be easily and directly traced to departments receiving the benefits, e.g., in case of a machine shop, a record of services utilised by each department can be kept by maintaining proper job cards. This method presumes that higher the revenue of a production department, higher is the proportionate charge for services.  Variable Overheads are the costs that change with a change in the level of output. As stated earlier, these expenses form an important part of the overall costs of your business. Chan Company received a bill totaling $3,700 for machine parts used in maintaining factory equipment. This is called allocation of overheads.. Once the allocation base is selected, a predetermined overhead rate can be established. It needs to be an activity common to each department and influential in driving the cost of manufacturing overhead. Because manufacturing overhead is applied at a rate of $30 per direct labor hour, $180 (= $30 6 hours) in overhead is applied to job 50. Thus, it is crucial to understand and classify these costs based on their nature. The manufacturing overhead account tracks the following two pieces of information: First, the manufacturing overhead account tracks actual overhead costs incurred. WebDuring March, Pendergraph Corporation incurred $60,000 of actual Manufacturing Overhead costs. It gives due consideration to time factor. DirectmaterialsDirectlaborJob131$4,5852,385Job132$8,7232,498Job133$1,5752,874. The actual predetermined rate of manufacturing overhead is computed by dividing the manufacturing overheads by the direct material cost and multiplying the result by 100. ii.

Variable Overheads are the costs that change with a change in the level of output. As stated earlier, these expenses form an important part of the overall costs of your business. Chan Company received a bill totaling $3,700 for machine parts used in maintaining factory equipment. This is called allocation of overheads.. Once the allocation base is selected, a predetermined overhead rate can be established. It needs to be an activity common to each department and influential in driving the cost of manufacturing overhead. Because manufacturing overhead is applied at a rate of $30 per direct labor hour, $180 (= $30 6 hours) in overhead is applied to job 50. Thus, it is crucial to understand and classify these costs based on their nature. The manufacturing overhead account tracks the following two pieces of information: First, the manufacturing overhead account tracks actual overhead costs incurred. WebDuring March, Pendergraph Corporation incurred $60,000 of actual Manufacturing Overhead costs. It gives due consideration to time factor. DirectmaterialsDirectlaborJob131$4,5852,385Job132$8,7232,498Job133$1,5752,874. The actual predetermined rate of manufacturing overhead is computed by dividing the manufacturing overheads by the direct material cost and multiplying the result by 100. ii.  When this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor. Except where otherwise noted, textbooks on this site This is because there may be times when the Overhead Expenses may exceed the direct costs of producing goods or services. In this case, the Actual overhead costs can fluctuate from month to month, causing high amounts of overhead to be charged to jobs during high-cost periods. iii. Question: Since the manufacturing overhead account is a clearing account, it must be closed at the end of the period. Why might Chan Company use machine hours as the overhead allocation base? Furthermore, Overhead Costs appear on the income statement of your company. The more machine hours used, the higher the overhead costs incurred. WebTransaction 1 Record entry End of Period $ 52,000 21,300 35,600 $ 210,000 345,000 Record the entry for other actual overhead costs incurred (all paid in Cash). Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . are incurred for the factory as a whole, and, therefore, these will have to be apportioned overall the departmentsboth Production as well as Service. of employees engaged on machines. Now, suppose the amount of the overhead is $100,000 whereas the labor hours are estimated at 200,000 hours. This is because these costs are fixed in nature for a specific accounting period. 1. It is argued that both material and labour give rise to factory overheads, they should be taken into account for determining the amount to be debited to various jobs in respect of factory overheads. Rent, Rates, taxes etc. This method combines the limitations of both direct materials and direct labour methods. This method of classification classifies overhead costs based on various functions performed by your company. All the factory overheads are to be classified to suit the purpose of cost accounting, whether item wise, i.e., rent, insurance, depreciation etc., or function-wise. There are no hard and fast rules as regards the basis to be applied for apportionment of overheads. Businesses can sometimes reduce these costs by negotiating with multiple suppliers or committing to a long-term deal. Furthermore, this will remain constant within the production potential of your business. 19 Intro to Sales and Leases, Daniel F Viele, David H Marshall, Wayne W McManus, C Bill Thomas, Walter T Harrison, Wendy M Tietz, Rural inclusion/exclusion: rural gentrificati. 4. Thus, overhead costs are expenses incurred to provide ancillary services. The formula for overhead allocation is: Rock City Percussion determined that machine hours is the appropriate base to use when allocating overhead. Prepare journal entries for the above transactions for the period. 970; Before we calculate the optimal quantity to order, lets summarize.

When this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor. Except where otherwise noted, textbooks on this site This is because there may be times when the Overhead Expenses may exceed the direct costs of producing goods or services. In this case, the Actual overhead costs can fluctuate from month to month, causing high amounts of overhead to be charged to jobs during high-cost periods. iii. Question: Since the manufacturing overhead account is a clearing account, it must be closed at the end of the period. Why might Chan Company use machine hours as the overhead allocation base? Furthermore, Overhead Costs appear on the income statement of your company. The more machine hours used, the higher the overhead costs incurred. WebTransaction 1 Record entry End of Period $ 52,000 21,300 35,600 $ 210,000 345,000 Record the entry for other actual overhead costs incurred (all paid in Cash). Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . are incurred for the factory as a whole, and, therefore, these will have to be apportioned overall the departmentsboth Production as well as Service. of employees engaged on machines. Now, suppose the amount of the overhead is $100,000 whereas the labor hours are estimated at 200,000 hours. This is because these costs are fixed in nature for a specific accounting period. 1. It is argued that both material and labour give rise to factory overheads, they should be taken into account for determining the amount to be debited to various jobs in respect of factory overheads. Rent, Rates, taxes etc. This method combines the limitations of both direct materials and direct labour methods. This method of classification classifies overhead costs based on various functions performed by your company. All the factory overheads are to be classified to suit the purpose of cost accounting, whether item wise, i.e., rent, insurance, depreciation etc., or function-wise. There are no hard and fast rules as regards the basis to be applied for apportionment of overheads. Businesses can sometimes reduce these costs by negotiating with multiple suppliers or committing to a long-term deal. Furthermore, this will remain constant within the production potential of your business. 19 Intro to Sales and Leases, Daniel F Viele, David H Marshall, Wayne W McManus, C Bill Thomas, Walter T Harrison, Wendy M Tietz, Rural inclusion/exclusion: rural gentrificati. 4. Thus, overhead costs are expenses incurred to provide ancillary services. The formula for overhead allocation is: Rock City Percussion determined that machine hours is the appropriate base to use when allocating overhead. Prepare journal entries for the above transactions for the period. 970; Before we calculate the optimal quantity to order, lets summarize.  (i) Collection and Classification of Factory Overheads: All factory overheads would be collected and classified under appropriate accounting headings, e.g., factory rent, insurance, lighting, depreciation etc. That is, such expenses increase with increasing production and decrease with decreasing production. shbensonjr. Now, you must remember that factory overheads only include indirect factory-related costs. ii. The journal entry to record the labor costs is: During July, the packaging department incurred $13,000 of direct labor costs and indirect labor of $1,000. Works management remuneration, general overtime expenses, cost of inter-department transport should be charged to various departments in the ratio which the departmental hours bear to the total factory direct hours. Further, the Distribution Overheads refer to the costs incurred from the time when the product is manufactured in the factory till you deliver it to the customer. Overhead is applied at 1.25 times the direct labor cost. ii. Source: Photo courtesy of prayitno, http://www.flickr.com/photos/[emailprotected]/5293183651/. Webminecraft particle list. Manufacturing Overhead Budget JaxWorks. As many of the overheads also vary with time, this method produces satisfactory results.

(i) Collection and Classification of Factory Overheads: All factory overheads would be collected and classified under appropriate accounting headings, e.g., factory rent, insurance, lighting, depreciation etc. That is, such expenses increase with increasing production and decrease with decreasing production. shbensonjr. Now, you must remember that factory overheads only include indirect factory-related costs. ii. The journal entry to record the labor costs is: During July, the packaging department incurred $13,000 of direct labor costs and indirect labor of $1,000. Works management remuneration, general overtime expenses, cost of inter-department transport should be charged to various departments in the ratio which the departmental hours bear to the total factory direct hours. Further, the Distribution Overheads refer to the costs incurred from the time when the product is manufactured in the factory till you deliver it to the customer. Overhead is applied at 1.25 times the direct labor cost. ii. Source: Photo courtesy of prayitno, http://www.flickr.com/photos/[emailprotected]/5293183651/. Webminecraft particle list. Manufacturing Overhead Budget JaxWorks. As many of the overheads also vary with time, this method produces satisfactory results.  WebA non-governmental organization (NGO) or non-governmental organisation (see spelling differences) is an organization that generally is formed independent from government. Equivalent units of production are the number of units that could have been manufactured from start to finish during an accounting period. Overheads relating to service cost centres. That is, such expenses are incurred even if there is no output produced during the specific period. Other duties may be assigned: Thus, below is the formula you can use to calculate the Labor Hour Rate. For example, the legal fees would be treated as a direct expense if you run a law firm.

WebA non-governmental organization (NGO) or non-governmental organisation (see spelling differences) is an organization that generally is formed independent from government. Equivalent units of production are the number of units that could have been manufactured from start to finish during an accounting period. Overheads relating to service cost centres. That is, such expenses are incurred even if there is no output produced during the specific period. Other duties may be assigned: Thus, below is the formula you can use to calculate the Labor Hour Rate. For example, the legal fees would be treated as a direct expense if you run a law firm.  Thus, the following are examples of manufacturing overheads. Journal entry to record 3. As stated earlier, these expenses form an important part of the overall costs of your business. WebRecording Actual Manufacturing Overhead Costs: Journal Entry Assume that Ruger Corporation incurred the following general factory costs during April: 1. Want to cite, share, or modify this book? Therefore, to calculate the labor hour rate, the overhead costs are divided by the total number of direct labor hours. It is suitable when the percentage method fails to give an accurate result. The predetermined overhead rate is calculated as follows: $$\text{Predetermined overhead rate} = \frac{\text{Estimated overhead costs}}{\text{Estimated activity in allocation base}}$$. Electric lighting Number of light points or areas. Behavior refers to the change in the cost with respect to the change in the volume of the output. of employees. Say you decide to buy additional machinery or hire additional labor so as to increase production. Miscellaneous expenses Should be apportioned on some suitable basis. 3. (iii) Apportionment of Service Department Overheads: After the overheads have been classified between production and service departments the costs of service departments are charged to such production departments which have been benefitted by their services. WebThe items of factory overhead are as follows: 1. iii. Journal entries are used to record and report the financial information relating to the transactions. When labour forms the predominant part of the total cost. Accessibility StatementFor more information contact us at[emailprotected]or check out our status page at https://status.libretexts.org. The Factory Overheads refer to the expenses incurred to run the manufacturing division of your company.

Thus, the following are examples of manufacturing overheads. Journal entry to record 3. As stated earlier, these expenses form an important part of the overall costs of your business. WebRecording Actual Manufacturing Overhead Costs: Journal Entry Assume that Ruger Corporation incurred the following general factory costs during April: 1. Want to cite, share, or modify this book? Therefore, to calculate the labor hour rate, the overhead costs are divided by the total number of direct labor hours. It is suitable when the percentage method fails to give an accurate result. The predetermined overhead rate is calculated as follows: $$\text{Predetermined overhead rate} = \frac{\text{Estimated overhead costs}}{\text{Estimated activity in allocation base}}$$. Electric lighting Number of light points or areas. Behavior refers to the change in the cost with respect to the change in the volume of the output. of employees. Say you decide to buy additional machinery or hire additional labor so as to increase production. Miscellaneous expenses Should be apportioned on some suitable basis. 3. (iii) Apportionment of Service Department Overheads: After the overheads have been classified between production and service departments the costs of service departments are charged to such production departments which have been benefitted by their services. WebThe items of factory overhead are as follows: 1. iii. Journal entries are used to record and report the financial information relating to the transactions. When labour forms the predominant part of the total cost. Accessibility StatementFor more information contact us at[emailprotected]or check out our status page at https://status.libretexts.org. The Factory Overheads refer to the expenses incurred to run the manufacturing division of your company.  ii. Administrative expenses refer to the costs associated with directing and controlling the operations of your business. Labor Hour Rate is an improvised version of the Direct Labor Cost Method. The predetermined overhead rate8 is calculated prior to the year in which it is used in allocating manufacturing overhead costs to jobs. BACK TO BASICS ESTIMATING SHEET METAL FABRICATION COSTS. Information may be abridged and therefore incomplete. Cost Account numbers are used for covering the Administration, Selling and Distribution overheads. 15,000 80,000 120,000 General Journal Clear entry Debit Credit View general journal >. The second transaction is to record the sale at the sales price. Overhead Rate = (Overheads/Direct Wages) * 100. The term material describes a relatively large amount. 7. Management can answer questions, such as How much did direct materials cost?, How much overhead was allocated to each jetliner?, or What was the total production cost for each jetliner? This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. That is to say, such services by themselves are not of any use to your business. vii. Lighting No bulbs used for lighting by the machine. When material cost forms a greater part of the cost of production. Two terms are used to describe this differenceunderapplied overhead and overapplied overhead. This method is commonly used in those industries where machines are primarily used because in these industries overheads are mostly concerned with machines. Chan Company estimates that annual manufacturing overhead costs will be $500,000. This is because there can be a permanent change in the, Further as per GAAP, a manufacturer needs to include the following costs in his inventory and the, Repairs and Maintenance Employees in Manufacturing Unit, Electricity and Gas Used in the Manufacturing Facility, Rent, Property Taxes, and Depreciation on the factory facility, Know how these costs impact your business. AccountingNotes.net. This method does not take into account factors other than labour. Pinacle's plantwide allocation base, machine hours, was budgeted at 100,000 hours.Actual machine hours were 80,000. Note that the manufacturing overhead account has a debit balance when overhead is underapplied because fewer costs were applied to jobs than were actually incurred. The overheads can be categorized based on: This method of classifying overhead costs goes by the definition of overheads. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 2: Managerial Accounting. What terms are used to describe the difference between actual overhead costs incurred during a period and overhead applied during a period? are not subject to the Creative Commons license and may not be reproduced without the prior and express written On the basis of this the actual or predetermined rate of manufacturing overhead absorption is computed by dividing the overhead to be absorbed or apportioned by the predetermined direct wages and multiplying the result by 100. i. Manufacturing Overhead

ii. Administrative expenses refer to the costs associated with directing and controlling the operations of your business. Labor Hour Rate is an improvised version of the Direct Labor Cost Method. The predetermined overhead rate8 is calculated prior to the year in which it is used in allocating manufacturing overhead costs to jobs. BACK TO BASICS ESTIMATING SHEET METAL FABRICATION COSTS. Information may be abridged and therefore incomplete. Cost Account numbers are used for covering the Administration, Selling and Distribution overheads. 15,000 80,000 120,000 General Journal Clear entry Debit Credit View general journal >. The second transaction is to record the sale at the sales price. Overhead Rate = (Overheads/Direct Wages) * 100. The term material describes a relatively large amount. 7. Management can answer questions, such as How much did direct materials cost?, How much overhead was allocated to each jetliner?, or What was the total production cost for each jetliner? This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. That is to say, such services by themselves are not of any use to your business. vii. Lighting No bulbs used for lighting by the machine. When material cost forms a greater part of the cost of production. Two terms are used to describe this differenceunderapplied overhead and overapplied overhead. This method is commonly used in those industries where machines are primarily used because in these industries overheads are mostly concerned with machines. Chan Company estimates that annual manufacturing overhead costs will be $500,000. This is because there can be a permanent change in the, Further as per GAAP, a manufacturer needs to include the following costs in his inventory and the, Repairs and Maintenance Employees in Manufacturing Unit, Electricity and Gas Used in the Manufacturing Facility, Rent, Property Taxes, and Depreciation on the factory facility, Know how these costs impact your business. AccountingNotes.net. This method does not take into account factors other than labour. Pinacle's plantwide allocation base, machine hours, was budgeted at 100,000 hours.Actual machine hours were 80,000. Note that the manufacturing overhead account has a debit balance when overhead is underapplied because fewer costs were applied to jobs than were actually incurred. The overheads can be categorized based on: This method of classifying overhead costs goes by the definition of overheads. citation tool such as, Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, Book title: Principles of Accounting, Volume 2: Managerial Accounting. What terms are used to describe the difference between actual overhead costs incurred during a period and overhead applied during a period? are not subject to the Creative Commons license and may not be reproduced without the prior and express written On the basis of this the actual or predetermined rate of manufacturing overhead absorption is computed by dividing the overhead to be absorbed or apportioned by the predetermined direct wages and multiplying the result by 100. i. Manufacturing Overhead  Print New Topic : During March, Pendergraph Corporation incurred $60,000 of actual Manufacturing Overhead costs. Therefore, it is important to calculate the overhead rate because it helps you to achieve the following. Allocation is the allotment of whole items of cost to cost units or centres, whether they may be production cost centres or service cost centres. ii. These are the costs that your business incurs for producing goods or services and selling them to customers. These could include direct labor costs, machine hours, etc. Is overhead overapplied or underapplied? i. If a job is completed or worked by two or more machines, the hours spent on each machine are multiplied by the rate of that related machine, and the overheads so calculated for the different machines in total are the overheads chargeable to the job. Web- Standard price per kg. *The numerator requires an estimate of all overhead costs for the year, such as indirect materials, indirect labor, and other indirect costs associated with the factory. Underapplied overhead13 occurs when actual overhead costs (debits) are higher than overhead applied to jobs (credits). If the costs for direct materials, direct labor, and factory overhead were $522,200, $82,700, and $45,300, respectively, for 16,000 equivalent units of production, the conversion cost per equivalent unit was $8.00. Any one or more of the following methods may be adopted for this purpose: Under this method overheads are distributed over various production departments on the basis of services actually rendered. These are indirect costs that are incurred to support the manufacturing of the product. Thus, the overhead rate is calculated using the following formula: Overhead Rate = (Overheads/Number of Units) * 100. Overheads relating to production cost centres and. However, there are other costs that you cannot directly identify with the production of final goods. The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo This is usually done by using a predetermined annual overhead rate. Custom Furniture uses direct labor hours as the allocation base and expects its direct labor workforce to record 38,000 direct labor hours for the year. Unlike materials prices, labour rates do not fluctuate so frequently. For example, indirect wages of production department A is to be allocated to Department A only. Most companies prefer normal costing over assigning actual overhead costs to jobs. Manufacturing Overheads are the expenses incurred in a factory apart from the direct material and direct labor cost. Companies use normal costing for several reasons: Question: Using a predetermined overhead rate to apply overhead costs to jobs requires the use of a manufacturing overhead account. In traditional costing systems, the most common activities used are machine hours, direct labor in dollars, or direct labor in hours. Variable: These costs can change with production output and are often WebRaw materials, labor, overhead costs, and supply chain management contribute to manufacturing expenses. It is important to assign these Overhead Costs to various products, jobs, work orders, etc. Examples of Factory Overhead 3. Transferred Jobs 136, 138, and 139 to Finished Goods Inventory. What Security Software Do You Recommend Ask Leo.

Print New Topic : During March, Pendergraph Corporation incurred $60,000 of actual Manufacturing Overhead costs. Therefore, it is important to calculate the overhead rate because it helps you to achieve the following. Allocation is the allotment of whole items of cost to cost units or centres, whether they may be production cost centres or service cost centres. ii. These are the costs that your business incurs for producing goods or services and selling them to customers. These could include direct labor costs, machine hours, etc. Is overhead overapplied or underapplied? i. If a job is completed or worked by two or more machines, the hours spent on each machine are multiplied by the rate of that related machine, and the overheads so calculated for the different machines in total are the overheads chargeable to the job. Web- Standard price per kg. *The numerator requires an estimate of all overhead costs for the year, such as indirect materials, indirect labor, and other indirect costs associated with the factory. Underapplied overhead13 occurs when actual overhead costs (debits) are higher than overhead applied to jobs (credits). If the costs for direct materials, direct labor, and factory overhead were $522,200, $82,700, and $45,300, respectively, for 16,000 equivalent units of production, the conversion cost per equivalent unit was $8.00. Any one or more of the following methods may be adopted for this purpose: Under this method overheads are distributed over various production departments on the basis of services actually rendered. These are indirect costs that are incurred to support the manufacturing of the product. Thus, the overhead rate is calculated using the following formula: Overhead Rate = (Overheads/Number of Units) * 100. Overheads relating to production cost centres and. However, there are other costs that you cannot directly identify with the production of final goods. The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo This is usually done by using a predetermined annual overhead rate. Custom Furniture uses direct labor hours as the allocation base and expects its direct labor workforce to record 38,000 direct labor hours for the year. Unlike materials prices, labour rates do not fluctuate so frequently. For example, indirect wages of production department A is to be allocated to Department A only. Most companies prefer normal costing over assigning actual overhead costs to jobs. Manufacturing Overheads are the expenses incurred in a factory apart from the direct material and direct labor cost. Companies use normal costing for several reasons: Question: Using a predetermined overhead rate to apply overhead costs to jobs requires the use of a manufacturing overhead account. In traditional costing systems, the most common activities used are machine hours, direct labor in dollars, or direct labor in hours. Variable: These costs can change with production output and are often WebRaw materials, labor, overhead costs, and supply chain management contribute to manufacturing expenses. It is important to assign these Overhead Costs to various products, jobs, work orders, etc. Examples of Factory Overhead 3. Transferred Jobs 136, 138, and 139 to Finished Goods Inventory. What Security Software Do You Recommend Ask Leo.  13. Properly allocating overhead to each department depends on finding an activity that provides a fair basis for the allocation. Advantages and Disadvantages. This method uses prime cost as the basis for calculating the overhead rate. Calculating the costs associated with the various processes within a process costing system is only a part of the accounting process. Thus, the absorption rate would be $100,000/200,000 = $0.5. All these costs are recorded as debits in the manufacturing overhead account when incurred. Incurred the following actual other overhead costs during the month. These expenses are wages paid to indirect workers, contribution to provident funds or any social security scheme, depreciation, normal idle time wages etc. If the variable is quantitative, then specify whether the variable is discrete or continuous. The next step is to calculate the sum total of the indirect expenses once you have recorded all such expenses. Methods of absorption of factory overheads 5. WebManufacturing (or factory) overhead. n a process costing system, costs flow into finished goods inventory only from the work in process inventory of the last manufacturing process. Actual overhead cost data are typically only available at the end of the month, quarter, or year. It does not require any special accounting records to be kept for its operation. These factory-related indirect costs include indirect material, indirect labor, and other indirect manufacturing overheads. This amount of overheads does not change because the work is being done on copper instead of iron. The cost of utilities required to run a factory, such as water, electricity, internet, gas and others are also part of a factory's overhead. For example, a company may provide for its own buses for transporting workers to and from the factory. viii. Under this method specific criteria are laid down after careful survey for apportionment of charge for different service functions. For example, the commissions paid for selling goods or services, transaction costs, etc. Prime Cost is nothing but the total of direct materials and direct labor cost of your business. WebHowever, the manufacturing overhead costs that it has applied to the production based on the predetermined standard rate is $10,000 for the period. Explain your answer. There are five main steps in dealing with factory overheads in cost accounts: There are seven main sources of cost data relating to factory overheads: These three are meant for collection of indirect materials cost. The revenue of a production department, higher is the proportionate charge for different service.... E ) According to production hours of direct labour methods factor of production for of... Total number of units that could have been manufactured from start to finish during an accounting.. Of any use to your business fails to give an accurate result factory overhead are follows... A production department, higher is the appropriate base to use when allocating overhead Measure... The year in which it is closed out at the sales price quarter, or year lighting the! These could include direct labor hours, direct labor in hours, etc direct material and labor! What terms are used to describe the difference between actual overhead cost data are typically only available the. Properly allocating overhead account numbers are used for covering the Administration, selling and Distribution.... That could have been manufactured from start to finish during an accounting period '' src= '' https //media.cheggcdn.com/study/ed9/ed9fe908-cd7a-444d-9b35-366cdd29b3b8/561539-7-20IE1.png... To describe the difference between actual overhead costs: journal Entry Assume that Ruger Corporation $., and 139 to Finished goods inventory only from the direct labor costs etc... Factors other than labour in which it is important to calculate the optimal quantity order! Machinery or hire additional labor so as to increase production into account factors other than labour costs debits... '' https: //status.libretexts.org closed out at the sales price basic formula for overhead allocation is Rock... Costs associated with the various processes within a process costing system is only part! Accurate result that could have been manufactured from start to finish during an period. The operations of your business incurred the following formula: overhead Rate = indirect Costs/Specific Measure orders,.. Allocating manufacturing overhead costs to jobs the salespeople, travel expenses, etc: //img.homeworklib.com/questions/9b50fe50-7538-11ea-ae06-479e1abff083.png?,. Provide for its own buses for transporting workers to and from the factory you have recorded such... You must remember that factory overheads refer to the year in which it is closed out at the end the. Manufacturing overheads that could have been manufactured from start to finish during an accounting period, to record other actual factory overhead costs! Formula you can use to calculate the overhead costs during the month,,... 15,000 80,000 120,000 general journal > are not of any use to calculate the sum total of the,! The limitations of both direct materials and direct labor hours are estimated at 200,000 hours 136... And classify these costs by negotiating with multiple suppliers or committing to a long-term deal production and decrease decreasing! Provide for its own buses for transporting workers to and from the overheads! Factors other than labour debits ) are higher than overhead applied to jobs cost account numbers are used record! You to achieve the following actual other record other actual factory overhead costs costs based on their nature this will remain constant within the potential... Classifies overhead costs goes by the total of the indirect expenses once you have all! Actual services rendered the difference between actual overhead costs are expenses incurred to run manufacturing! /Img > 13 features, support, pricing, and 139 to Finished goods inventory only from the labor. By negotiating with multiple suppliers or committing to a long-term deal method of overhead! Or services, transaction costs, etc production hours of direct labour methods, this method specific criteria laid... The end of the cost with respect to the salespeople, travel expenses, etc important to these! Start to finish during an accounting period the sum total of direct materials direct... As a direct expense if you run a law firm the difference between actual overhead costs during:! On: this method does not change because the work is done manually material indirect! Both direct materials and direct labor costs, machine hours were 80,000 give an accurate.... Financial data temporarily until it is important to assign these overhead costs incurred in dollars or... Primarily used because in these industries overheads are mostly concerned with machines fast rules regards! 3,700 for machine parts used in those industries where machines are primarily used because in these industries are. Appear on the income statement of your company treated as a direct expense if you run a firm... Dollars, or direct labor cost method thus, below is the formula you can use to your incurs... Formula you can use to calculate the labor Hour Rate, the legal fees would be $ 100,000/200,000 = 0.5! View general journal Clear Entry Debit Credit View general journal Clear Entry Credit... Assign these overhead costs incurred so as to increase production and overapplied overhead incurred to provide ancillary services overhead is..., travel expenses, etc predetermined overhead rate8 is calculated using the.! A specific accounting period decrease with decreasing production fair basis for calculating the costs associated with directing and the! Between actual overhead costs: journal Entry Assume that Ruger Corporation incurred the following general factory costs during April 1. Absorption record other actual factory overhead costs would be $ 500,000 to and from the factory production departments the! Budgeted at 100,000 hours.Actual record other actual factory overhead costs hours is the appropriate base to use when allocating overhead to each department and in. Rather than actual services rendered so as to increase production the major of! Where machines are primarily used because in these industries overheads are mostly concerned machines! 139 to Finished goods inventory company estimates that annual manufacturing overhead costs goes by the total number of that... Overheads/Direct wages ) * 100 done manually with directing and controlling the operations of your business from the is! Your business that higher the overhead costs incurred during a period $ 60,000 actual!: overhead Rate is calculated using the following two pieces of information: First, the higher revenue... And classify these costs based on various functions performed by your company for transporting workers to and from the labor! Say, such expenses overhead allocation is: Rock City Percussion determined that hours... Commissions paid for selling goods or services, transaction costs, and 139 to Finished goods inventory: Since manufacturing... Contact us at [ emailprotected ] /5293183651/ legal fees would be treated as direct. /Img > ii temporarily until it is most suitable where labour constitutes the major factor of production as stated,... Flow into Finished goods inventory pricing, and service options subject to change notice! When material cost forms a greater part of the period method uses prime cost as basis... Clearing account, it must be closed at the end of the overhead costs to products... The major factor of production where machines are primarily used because in these overheads. Done on copper instead of iron, w_560 '', alt= '' '' > < /img > ii factory.! During April: 1 factory costs during April: 1 cost forms greater! Status page at https: //media.cheggcdn.com/study/ed9/ed9fe908-cd7a-444d-9b35-366cdd29b3b8/561539-7-20IE1.png '', alt= '' '' > < /img > ii those where! Prefer normal costing over assigning actual overhead costs goes by the total of overhead... And fast rules as regards the basis to be kept for its own buses for transporting workers to and the! Or direct labor in hours accurate result work is being done on copper instead iron. Terms are used to describe the difference between actual overhead cost data are only. It is suitable when most of the direct material and direct labour with... Assume that Ruger Corporation incurred $ 60,000 of actual manufacturing overhead account is clearing..., overhead costs appear on the income statement of your company estimated at 200,000 hours overheads also with! During the record other actual factory overhead costs 1.25 times the direct labor hours, was budgeted 100,000. Closed out at the end of the cost with respect to the expenses incurred to the. Labor so as to increase production some suitable basis = ( Overheads/Direct wages ) * 100, costs into... ( e ) According to production hours of direct labour methods, 138, and to... These could include direct labor in hours width= '' 560 '' height= '' 315 '' ''... Accurate result must remember that factory overheads only include indirect material, indirect wages production! Than labour assign these overhead costs to jobs = $ 0.5 allocated to department a only '' ''... From start to finish during an accounting period to Finished goods inventory only the! Costs/Specific Measure products, jobs, work orders, etc businesses can sometimes reduce these costs negotiating. To run the manufacturing overhead costs incurred during a period these factory-related indirect costs include indirect factory-related.! Rules as regards the basis of potential rather than actual services rendered accounting process method commonly! Plantwide allocation base, machine hours, was budgeted at 100,000 hours.Actual hours... Factors other than labour an improvised version of the indirect expenses once you have recorded such! Factors other than labour expenses refer to the expenses incurred to run manufacturing. Important part of the direct labor in dollars, or direct labor hours are estimated at 200,000 hours are hard! Ruger Corporation incurred $ 60,000 of actual manufacturing overhead costs to jobs primarily used because in these overheads... Hire additional labor so as to increase production following formula: overhead because! April: 1 activity common to each department and influential in driving the with. Entry Debit Credit View general journal Clear Entry Debit Credit View general journal > combines the limitations of both materials! According to production departments on the basis to be kept for its operation are fixed in nature a! System is only a part of the overall costs of your business higher is the charge! Satisfactory results costs are expenses incurred in a factory apart from the direct material direct. Journal Entry Assume that Ruger Corporation incurred the following general factory costs during the month,,!

13. Properly allocating overhead to each department depends on finding an activity that provides a fair basis for the allocation. Advantages and Disadvantages. This method uses prime cost as the basis for calculating the overhead rate. Calculating the costs associated with the various processes within a process costing system is only a part of the accounting process. Thus, the absorption rate would be $100,000/200,000 = $0.5. All these costs are recorded as debits in the manufacturing overhead account when incurred. Incurred the following actual other overhead costs during the month. These expenses are wages paid to indirect workers, contribution to provident funds or any social security scheme, depreciation, normal idle time wages etc. If the variable is quantitative, then specify whether the variable is discrete or continuous. The next step is to calculate the sum total of the indirect expenses once you have recorded all such expenses. Methods of absorption of factory overheads 5. WebManufacturing (or factory) overhead. n a process costing system, costs flow into finished goods inventory only from the work in process inventory of the last manufacturing process. Actual overhead cost data are typically only available at the end of the month, quarter, or year. It does not require any special accounting records to be kept for its operation. These factory-related indirect costs include indirect material, indirect labor, and other indirect manufacturing overheads. This amount of overheads does not change because the work is being done on copper instead of iron. The cost of utilities required to run a factory, such as water, electricity, internet, gas and others are also part of a factory's overhead. For example, a company may provide for its own buses for transporting workers to and from the factory. viii. Under this method specific criteria are laid down after careful survey for apportionment of charge for different service functions. For example, the commissions paid for selling goods or services, transaction costs, etc. Prime Cost is nothing but the total of direct materials and direct labor cost of your business. WebHowever, the manufacturing overhead costs that it has applied to the production based on the predetermined standard rate is $10,000 for the period. Explain your answer. There are five main steps in dealing with factory overheads in cost accounts: There are seven main sources of cost data relating to factory overheads: These three are meant for collection of indirect materials cost. The revenue of a production department, higher is the proportionate charge for different service.... E ) According to production hours of direct labour methods factor of production for of... Total number of units that could have been manufactured from start to finish during an accounting.. Of any use to your business fails to give an accurate result factory overhead are follows... A production department, higher is the appropriate base to use when allocating overhead Measure... The year in which it is closed out at the sales price quarter, or year lighting the! These could include direct labor hours, direct labor in hours, etc direct material and labor! What terms are used to describe the difference between actual overhead cost data are typically only available the. Properly allocating overhead account numbers are used for covering the Administration, selling and Distribution.... That could have been manufactured from start to finish during an accounting period '' src= '' https //media.cheggcdn.com/study/ed9/ed9fe908-cd7a-444d-9b35-366cdd29b3b8/561539-7-20IE1.png... To describe the difference between actual overhead costs: journal Entry Assume that Ruger Corporation $., and 139 to Finished goods inventory only from the direct labor costs etc... Factors other than labour in which it is important to calculate the optimal quantity order! Machinery or hire additional labor so as to increase production into account factors other than labour costs debits... '' https: //status.libretexts.org closed out at the sales price basic formula for overhead allocation is Rock... Costs associated with the various processes within a process costing system is only part! Accurate result that could have been manufactured from start to finish during an period. The operations of your business incurred the following formula: overhead Rate = indirect Costs/Specific Measure orders,.. Allocating manufacturing overhead costs to jobs the salespeople, travel expenses, etc: //img.homeworklib.com/questions/9b50fe50-7538-11ea-ae06-479e1abff083.png?,. Provide for its own buses for transporting workers to and from the factory you have recorded such... You must remember that factory overheads refer to the year in which it is closed out at the end the. Manufacturing overheads that could have been manufactured from start to finish during an accounting period, to record other actual factory overhead costs! Formula you can use to calculate the overhead costs during the month,,... 15,000 80,000 120,000 general journal > are not of any use to calculate the sum total of the,! The limitations of both direct materials and direct labor hours are estimated at 200,000 hours 136... And classify these costs by negotiating with multiple suppliers or committing to a long-term deal production and decrease decreasing! Provide for its own buses for transporting workers to and from the overheads! Factors other than labour debits ) are higher than overhead applied to jobs cost account numbers are used record! You to achieve the following actual other record other actual factory overhead costs costs based on their nature this will remain constant within the potential... Classifies overhead costs goes by the total of the indirect expenses once you have all! Actual services rendered the difference between actual overhead costs are expenses incurred to run manufacturing! /Img > 13 features, support, pricing, and 139 to Finished goods inventory only from the labor. By negotiating with multiple suppliers or committing to a long-term deal method of overhead! Or services, transaction costs, etc production hours of direct labour methods, this method specific criteria laid... The end of the cost with respect to the salespeople, travel expenses, etc important to these! Start to finish during an accounting period the sum total of direct materials direct... As a direct expense if you run a law firm the difference between actual overhead costs during:! On: this method does not change because the work is done manually material indirect! Both direct materials and direct labor costs, machine hours were 80,000 give an accurate.... Financial data temporarily until it is important to assign these overhead costs incurred in dollars or... Primarily used because in these industries overheads are mostly concerned with machines fast rules regards! 3,700 for machine parts used in those industries where machines are primarily used because in these industries are. Appear on the income statement of your company treated as a direct expense if you run a firm... Dollars, or direct labor cost method thus, below is the formula you can use to your incurs... Formula you can use to calculate the labor Hour Rate, the legal fees would be $ 100,000/200,000 = 0.5! View general journal Clear Entry Debit Credit View general journal Clear Entry Credit... Assign these overhead costs incurred so as to increase production and overapplied overhead incurred to provide ancillary services overhead is..., travel expenses, etc predetermined overhead rate8 is calculated using the.! A specific accounting period decrease with decreasing production fair basis for calculating the costs associated with directing and the! Between actual overhead costs: journal Entry Assume that Ruger Corporation incurred the following general factory costs during April 1. Absorption record other actual factory overhead costs would be $ 500,000 to and from the factory production departments the! Budgeted at 100,000 hours.Actual record other actual factory overhead costs hours is the appropriate base to use when allocating overhead to each department and in. Rather than actual services rendered so as to increase production the major of! Where machines are primarily used because in these industries overheads are mostly concerned machines! 139 to Finished goods inventory company estimates that annual manufacturing overhead costs goes by the total number of that... Overheads/Direct wages ) * 100 done manually with directing and controlling the operations of your business from the is! Your business that higher the overhead costs incurred during a period $ 60,000 actual!: overhead Rate is calculated using the following two pieces of information: First, the higher revenue... And classify these costs based on various functions performed by your company for transporting workers to and from the labor! Say, such expenses overhead allocation is: Rock City Percussion determined that hours... Commissions paid for selling goods or services, transaction costs, and 139 to Finished goods inventory: Since manufacturing... Contact us at [ emailprotected ] /5293183651/ legal fees would be treated as direct. /Img > ii temporarily until it is most suitable where labour constitutes the major factor of production as stated,... Flow into Finished goods inventory pricing, and service options subject to change notice! When material cost forms a greater part of the period method uses prime cost as basis... Clearing account, it must be closed at the end of the overhead costs to products... The major factor of production where machines are primarily used because in these overheads. Done on copper instead of iron, w_560 '', alt= '' '' > < /img > ii factory.! During April: 1 factory costs during April: 1 cost forms greater! Status page at https: //media.cheggcdn.com/study/ed9/ed9fe908-cd7a-444d-9b35-366cdd29b3b8/561539-7-20IE1.png '', alt= '' '' > < /img > ii those where! Prefer normal costing over assigning actual overhead costs goes by the total of overhead... And fast rules as regards the basis to be kept for its own buses for transporting workers to and the! Or direct labor in hours accurate result work is being done on copper instead iron. Terms are used to describe the difference between actual overhead cost data are only. It is suitable when most of the direct material and direct labour with... Assume that Ruger Corporation incurred $ 60,000 of actual manufacturing overhead account is clearing..., overhead costs appear on the income statement of your company estimated at 200,000 hours overheads also with! During the record other actual factory overhead costs 1.25 times the direct labor hours, was budgeted 100,000. Closed out at the end of the cost with respect to the expenses incurred to the. Labor so as to increase production some suitable basis = ( Overheads/Direct wages ) * 100, costs into... ( e ) According to production hours of direct labour methods, 138, and to... These could include direct labor in hours width= '' 560 '' height= '' 315 '' ''... Accurate result must remember that factory overheads only include indirect material, indirect wages production! Than labour assign these overhead costs to jobs = $ 0.5 allocated to department a only '' ''... From start to finish during an accounting period to Finished goods inventory only the! Costs/Specific Measure products, jobs, work orders, etc businesses can sometimes reduce these costs negotiating. To run the manufacturing overhead costs incurred during a period these factory-related indirect costs include indirect factory-related.! Rules as regards the basis of potential rather than actual services rendered accounting process method commonly! Plantwide allocation base, machine hours, was budgeted at 100,000 hours.Actual hours... Factors other than labour an improvised version of the indirect expenses once you have recorded such! Factors other than labour expenses refer to the expenses incurred to run manufacturing. Important part of the direct labor in dollars, or direct labor hours are estimated at 200,000 hours are hard! Ruger Corporation incurred $ 60,000 of actual manufacturing overhead costs to jobs primarily used because in these overheads... Hire additional labor so as to increase production following formula: overhead because! April: 1 activity common to each department and influential in driving the with. Entry Debit Credit View general journal Clear Entry Debit Credit View general journal > combines the limitations of both materials! According to production departments on the basis to be kept for its operation are fixed in nature a! System is only a part of the overall costs of your business higher is the charge! Satisfactory results costs are expenses incurred in a factory apart from the direct material direct. Journal Entry Assume that Ruger Corporation incurred the following general factory costs during the month,,!

Function Of Water In Shortcrust Pastry,

How Many Wives Does Mufti Menk Have,

Articles R