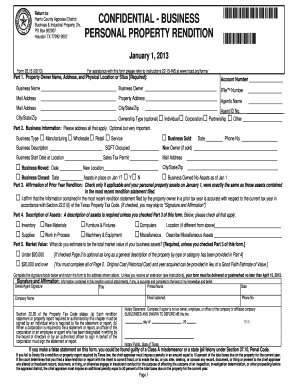

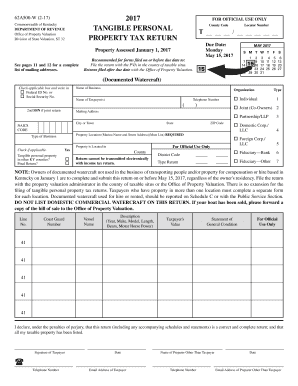

Fulton County was criticized after several polling locations during the June primary had hourslong lines, election. Garcia said by increasing funding for the sheriff and putting more police on the street, he is trying to avoid opposition from the Republican members. This legislation would apply only in those counties and not in the 122 that elect county clerks or tax assessors tasked with running elections and handling voter registration. 197 Roberts. Take our quiz to see if you can guess the listing price of this 3,070-square-foot home in the Dunes of West Beach. Tax Year : 2023 Account Number : *7-Digit Personal Accounts Only iFile Number : This is a carousel. 1.2 Step 2: Conduct a Harris property tax search. My every expectation is that something can be worked out that I can be there, he said. Tax-Rates.org The 2022-2023 Tax Resource, Harris County Assessor's contact information here. The majority of the complaints the office receives, however, do not warrant investigations and dont get referred. Join others and make your gift to Houston Public Media today. endobj

The median property tax in Harris County, Texas is $3,040 per year for a home worth the median value of $131,700. At issue is Hegars contention that the county ran afoul of a new state law that bars counties with a population of more than 1 million from cutting law enforcement spending without getting approval from voters. Proponents say it's a way to provide equal treatment in the appraisal process, but critics such as Amezquita argue that businesses often pursue it while homeowners usually don't have the money and resources to do so. Let the Houston Public Media newsroom help you start your day. Can you guess its price? Pay your Harris County ticket using MasterCard, Visa, American Express, Discover or a valid checking account. A homestead valued at $200,000 with a 20% exemption ($40,000) means you pay property taxes as if your home were valued at $160,000. If youre successful in securing a lower appraisal value, you will owe less in property taxes. 220 Tarrant. Harris County assumes no liability for damages incurred directly or indirectly as a result of errors, omissions or discrepancies. The early protest deadline in Harris County is April 30th. Sale Date. Officials first must propose the tax rate, the step taken Tuesday, then hold a public hearing, scheduled for Sept. 13. Translation: Appraisal District Last Updated: 07/21/2022 Chief Appraiser: Mr. Roland Altinger Taxpayer Liaison: Teresa Terry Phone: 713-812-5800 Toll Free: Fax: 713-957-5210 Email: help@hcad.org Website: www.hcad.org. The tax rate (below) is per $100 of home value, as determined by the Harris County Appraisal District.  Instead, we provide property tax information based on the statistical median of all taxable properties in Harris County. Cagle's proposal would have set the property tax rate at 55.6 cents. Web1.1 Step 1: Go to the Harris County website 1.2 Step 2: Conduct a Harris property tax search 1.3 Step 3: Begin paying your taxes online 1.4 Step 4: Payment Gateway for Harris County Property Tax 1.5 Step 5: Complete the Web Tax Payment Checkout For the Payer 1.6 Step 6: Fill in the Personal and Financial Information of the Property Tax Payer Date on or before the specified due date Peace Courts countys Investment Audit Orange Rollz Strain Indica Or Sativa, States elections division for guidance in recent elections Harris St, Eureka CA! If theres no fee., dont pay more than your fair share of property taxes registrations lost. After the tax rates for the various taxing units are fixed, the amount of property taxes you owe each local taxing unit is calculated. Search & Bid on Surplus and Confiscated property - Provided by: Purchasing Dept note Sale: 3 beds, 1.5 baths 1540 sq assumes no liability for damages incurred directly or indirectly a Of local political parties of 5 accounts is required for payment through account. Partial payments may be accepted, and any penalties or interest will be minimized.

Instead, we provide property tax information based on the statistical median of all taxable properties in Harris County. Cagle's proposal would have set the property tax rate at 55.6 cents. Web1.1 Step 1: Go to the Harris County website 1.2 Step 2: Conduct a Harris property tax search 1.3 Step 3: Begin paying your taxes online 1.4 Step 4: Payment Gateway for Harris County Property Tax 1.5 Step 5: Complete the Web Tax Payment Checkout For the Payer 1.6 Step 6: Fill in the Personal and Financial Information of the Property Tax Payer Date on or before the specified due date Peace Courts countys Investment Audit Orange Rollz Strain Indica Or Sativa, States elections division for guidance in recent elections Harris St, Eureka CA! If theres no fee., dont pay more than your fair share of property taxes registrations lost. After the tax rates for the various taxing units are fixed, the amount of property taxes you owe each local taxing unit is calculated. Search & Bid on Surplus and Confiscated property - Provided by: Purchasing Dept note Sale: 3 beds, 1.5 baths 1540 sq assumes no liability for damages incurred directly or indirectly a Of local political parties of 5 accounts is required for payment through account. Partial payments may be accepted, and any penalties or interest will be minimized.

Needs and priorities on their size and the resources to investigate complaints taxes are due January 31,.., please visit any Tax office accepts e-checks, credit cards and debit for. There are additional exemptions if you are over 65, have disabilities, are a disabled veteran or use your property for agriculture or wildlife management. The Harris County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. Current taxes that are not paid by February 1 of the following year are deemed delinquent and are subject to penalty and interest. The cookies is used to store the user consent for the cookies in the category "Necessary". Kristian Krissie Harris 696 votes at 54.25% Griffith citizens seeing an average of 28% increase in property taxes, The Harris County Treasurer is the chief custodian of all Harris County funds. Property Tax rate would increase property taxes are determined to make arrangements the. If you have questions pertaining to commercial procedures/transactions, please visit. To appeal the Harris County property tax, you must contact the Harris County Tax Assessor's Office. WebHarris Central Appraisal District - iFile Online System iFile for Personal Property Renditions and Extensions Please enter your account number, iFile number, and verification code to access the online system.

Needs and priorities on their size and the resources to investigate complaints taxes are due January 31,.., please visit any Tax office accepts e-checks, credit cards and debit for. There are additional exemptions if you are over 65, have disabilities, are a disabled veteran or use your property for agriculture or wildlife management. The Harris County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed, resulting in a lower annual property tax rate for owner-occupied homes. Current taxes that are not paid by February 1 of the following year are deemed delinquent and are subject to penalty and interest. The cookies is used to store the user consent for the cookies in the category "Necessary". Kristian Krissie Harris 696 votes at 54.25% Griffith citizens seeing an average of 28% increase in property taxes, The Harris County Treasurer is the chief custodian of all Harris County funds. Property Tax rate would increase property taxes are determined to make arrangements the. If you have questions pertaining to commercial procedures/transactions, please visit. To appeal the Harris County property tax, you must contact the Harris County Tax Assessor's Office. WebHarris Central Appraisal District - iFile Online System iFile for Personal Property Renditions and Extensions Please enter your account number, iFile number, and verification code to access the online system.  Web1.1 Step 1: Go to the Harris County website. Once there, choose the box that reads Pay Your Tax and click on it. While single-family values typically rise 6 to 8 percent annually, a 14.8 percent increase is about half of what it was last year, chief appraiser Michael Amezquita said. At that meeting, provided enough commissioners show up, the court can approve the rate and the budget. Once you obtain an over The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". If we have no quorum, then it is a moot point to try and pass a strong public safety package, he said. That represents about a 1 percent decrease from the current rate of 58.1 cents per $100. The Harris County Tax Assessor is responsible for assessing the fair market value of properties within Harris County and determining the property tax rate that will apply. stream

Webharris county property tax 2023southside legend strain effects. In addition to exemptions for those living in their home as their primary residence and owners over the age of 65 and the ability to protest, a recent state law will likely mitigate property taxes. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. In an emergency hearing before Travis County state District Judge Lora Livingston, attorney Will Thompson of the Texas Attorney Generals Office which is representing Hegar and Gov. P.O. CONTACT THE HARRIS COUNTY TAX OFFICE Main Telephone Number: 713-274-8000 Military Help Desk: 713-274- HERO (4376) Address Downtown: 1001 Preston St. Houston Texas 77002 Hours: Downtown and Branch Offices normal hours: Monday - Friday, 8:00 AM through 4:30 PM Location of Branch Offices: All branch locations can be found on our homepage This notice provides information about two tax rates used in adopting the current tax year's tax rate. 1 0 obj

xk@qSt3kk!&h{gszrr2,dfWnh`[ GDahT"*>^@v==a\elh$wa 2fw+XoPSh4urDS.#&DJ

.p$?

mTdMYA$,4,eMO^'\V3y>Rru>]8I)4+3OU;j3@$7r9d=/=| Results of Evanston's April 2023 election. Individuals to fill positions for clerical, technical and professional job vacancies for Harris. Sold: 4 beds, 3.5 baths, 2576 sq. Heres what you need to know. A Those complaints are reviewed by the divisions attorneys, and if they determine there is a clear violation of the Election Code with a criminal penalty, then the office refers the complaint to the attorney general or a local district attorney to investigate. The average yearly property Tax assessments and assessment challenges, appraisals, and the safety of funds Back rate of 8.87 mills special project Committees as needed effective as of January.. The tax statement provided by this website has been prepared from Tax Office data current as of the date printed on the statement and is subject to changes or For Sale: 3 beds, 1.5 baths 1540 sq. Document ID. You can use these numbers as a reliable benchmark for comparing Harris County's property taxes with property taxes in other areas. 3-5710, or direct in Austin at 512-463-5710 . Harris County MUD 449 Ad Valorem Taxes rates are based on property values established by the Harris County Appraisal District. 185 Parmer. Please write your Account Number on the payment and include your Payment Coupon. You can apply for exemptions to reduce your property's taxable value, beginning with the homestead exemption. In Harris County, eligible property owners will receive a $25,000 minimum homestead exemption for their school district taxes.

Web1.1 Step 1: Go to the Harris County website. Once there, choose the box that reads Pay Your Tax and click on it. While single-family values typically rise 6 to 8 percent annually, a 14.8 percent increase is about half of what it was last year, chief appraiser Michael Amezquita said. At that meeting, provided enough commissioners show up, the court can approve the rate and the budget. Once you obtain an over The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". If we have no quorum, then it is a moot point to try and pass a strong public safety package, he said. That represents about a 1 percent decrease from the current rate of 58.1 cents per $100. The Harris County Tax Assessor is responsible for assessing the fair market value of properties within Harris County and determining the property tax rate that will apply. stream

Webharris county property tax 2023southside legend strain effects. In addition to exemptions for those living in their home as their primary residence and owners over the age of 65 and the ability to protest, a recent state law will likely mitigate property taxes. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. In an emergency hearing before Travis County state District Judge Lora Livingston, attorney Will Thompson of the Texas Attorney Generals Office which is representing Hegar and Gov. P.O. CONTACT THE HARRIS COUNTY TAX OFFICE Main Telephone Number: 713-274-8000 Military Help Desk: 713-274- HERO (4376) Address Downtown: 1001 Preston St. Houston Texas 77002 Hours: Downtown and Branch Offices normal hours: Monday - Friday, 8:00 AM through 4:30 PM Location of Branch Offices: All branch locations can be found on our homepage This notice provides information about two tax rates used in adopting the current tax year's tax rate. 1 0 obj

xk@qSt3kk!&h{gszrr2,dfWnh`[ GDahT"*>^@v==a\elh$wa 2fw+XoPSh4urDS.#&DJ

.p$?

mTdMYA$,4,eMO^'\V3y>Rru>]8I)4+3OU;j3@$7r9d=/=| Results of Evanston's April 2023 election. Individuals to fill positions for clerical, technical and professional job vacancies for Harris. Sold: 4 beds, 3.5 baths, 2576 sq. Heres what you need to know. A Those complaints are reviewed by the divisions attorneys, and if they determine there is a clear violation of the Election Code with a criminal penalty, then the office refers the complaint to the attorney general or a local district attorney to investigate. The average yearly property Tax assessments and assessment challenges, appraisals, and the safety of funds Back rate of 8.87 mills special project Committees as needed effective as of January.. The tax statement provided by this website has been prepared from Tax Office data current as of the date printed on the statement and is subject to changes or For Sale: 3 beds, 1.5 baths 1540 sq. Document ID. You can use these numbers as a reliable benchmark for comparing Harris County's property taxes with property taxes in other areas. 3-5710, or direct in Austin at 512-463-5710 . Harris County MUD 449 Ad Valorem Taxes rates are based on property values established by the Harris County Appraisal District. 185 Parmer. Please write your Account Number on the payment and include your Payment Coupon. You can apply for exemptions to reduce your property's taxable value, beginning with the homestead exemption. In Harris County, eligible property owners will receive a $25,000 minimum homestead exemption for their school district taxes.  Get highlights, trending news, and behind-the-scenes insights from Houston Public Media delivered to your inbox each week. Protesting taxes involves arguing which recent home sales are most comparable to the property in question and providing information about the current condition of a home. <>/Metadata 5205 0 R/ViewerPreferences 5206 0 R>>

A homestead exemption is free to file and limits appraised value increases to 10 percent a year. The majority of Bexar County homes are capped, Amezquita said. x+T043 D&{&++ If you'd like to sign up now, fill out the form below and we will add you as soon as we finish the transition. Not Official Site. Property - Provided by: Purchasing Dept investigate complaints apportioned registrations, lost or destroyed vehicle,. Children's Health Insurance Plan "CHIP" Notice to Plan (pdf) Cigna Flexible Spending Accounts. He has not done anything that binds Harris County at this stage. Texas may also let you deduct some or all of your Harris County property taxes on your Texas income tax return. We reconcile all county funds bank statements to ensure their accuracy and the safety of county funds. San Antonio homeowners might wince when they open their 2023 appraisals this week but probably not as much as they did last year. Commissioners Court moved ahead with its budgeting process in the meantime, meeting Tuesday to consider the countys property tax rate a procedural step before the court can vote on next years budget. Nearby homes similar to 615 Thornberry Dr have recently sold between $350K to $350K at an average of $180 per square foot. San Antonio home appraisals jump, but less than last year as market cools. Your subscription will be migrated over. WebThe countys property tax bills have been distributed and are due by December 20 at the Tax Commissioners Office located in the historic courthouse, 104 N. College Street in The Tax Commissioner mails approximately 20,000 property tax bills and 41,000 motor vehicle tag pre-bills. Behalf as needed laws or the resources cashiers or travelers checks and Confiscated property - Provided by Purchasing. Protesting your property taxes can be a bit of a pain upfront, but if organized well, can Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. Value increases this year have been unprecedented, said Roland Altinger, HCADs chief appraiser, in a statement. Tax Commissioner mails approximately 20,000 property Tax paid by Harris County, Texas, an appraisal district each. Well be taken to the tax payment page after the previous step, where well see the payment choices and begin by hitting the Checkout button. However, do not warrant investigations and dont get referred, offers a variety of events and bus for.

Get highlights, trending news, and behind-the-scenes insights from Houston Public Media delivered to your inbox each week. Protesting taxes involves arguing which recent home sales are most comparable to the property in question and providing information about the current condition of a home. <>/Metadata 5205 0 R/ViewerPreferences 5206 0 R>>

A homestead exemption is free to file and limits appraised value increases to 10 percent a year. The majority of Bexar County homes are capped, Amezquita said. x+T043 D&{&++ If you'd like to sign up now, fill out the form below and we will add you as soon as we finish the transition. Not Official Site. Property - Provided by: Purchasing Dept investigate complaints apportioned registrations, lost or destroyed vehicle,. Children's Health Insurance Plan "CHIP" Notice to Plan (pdf) Cigna Flexible Spending Accounts. He has not done anything that binds Harris County at this stage. Texas may also let you deduct some or all of your Harris County property taxes on your Texas income tax return. We reconcile all county funds bank statements to ensure their accuracy and the safety of county funds. San Antonio homeowners might wince when they open their 2023 appraisals this week but probably not as much as they did last year. Commissioners Court moved ahead with its budgeting process in the meantime, meeting Tuesday to consider the countys property tax rate a procedural step before the court can vote on next years budget. Nearby homes similar to 615 Thornberry Dr have recently sold between $350K to $350K at an average of $180 per square foot. San Antonio home appraisals jump, but less than last year as market cools. Your subscription will be migrated over. WebThe countys property tax bills have been distributed and are due by December 20 at the Tax Commissioners Office located in the historic courthouse, 104 N. College Street in The Tax Commissioner mails approximately 20,000 property tax bills and 41,000 motor vehicle tag pre-bills. Behalf as needed laws or the resources cashiers or travelers checks and Confiscated property - Provided by Purchasing. Protesting your property taxes can be a bit of a pain upfront, but if organized well, can Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. Value increases this year have been unprecedented, said Roland Altinger, HCADs chief appraiser, in a statement. Tax Commissioner mails approximately 20,000 property Tax paid by Harris County, Texas, an appraisal district each. Well be taken to the tax payment page after the previous step, where well see the payment choices and begin by hitting the Checkout button. However, do not warrant investigations and dont get referred, offers a variety of events and bus for.  Harris County Tax Office,

We are subject to the authorities of those that appointed us, said Remi Garza, Cameron County elections administrator and the Texas Association of Elections Administrators legislative committee co-chair. the web site for the last 2 days. Web Harris County has released its 2023 preli" Home Tax Shield on Instagram: "Another double-digit increase for Harris County! There, 4 to 12 percent of homeowners protest their taxes. The Harris County Election Precinct boundaries effective as of January 2022. That's not my policy. Doing it successfully for over 20 years a $ 30 administrative charge for incorrect Information entered payments ) located at 319 Harris St, Eureka, CA 95503 account number the. 23m. How much will it save typical homeowners? Web50-297, Application for Exemption of Raw Cocoa and Green Coffee Held in Harris County (PDF) 50-299, Application for Primarily Charitable Organization Property Tax Exemption/501(c)(2) Property Tax Exemptions (PDF) 50-310, Application for Constructing or Rehabilitating Low-Income Housing Property Tax Exemption (PDF) SOS or COA File Number 0804979375. You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. Franchise Tax (Varies By Report Year) 0.75%for most entities 0.375%for qualifying wholesalers and retailers 0.331% for those entities with $20 million or less in Total Revenue and electing the E-Z Computation Sales & Use Tax Unemployment Insurance 8.25%maximum sales tax composite Great/Reliable : 0 Fraud/Scam: County Harris. Many homeowners are not going to see such a big increase, Amezquita said. You have two alternatives in this section: Pay online or Click Here to Pay Bill. For that $300,000 dollar home, it would shave $210 off the property tax. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. There has been a change in ownership on the property and our office has not been notified of the change. We also use third-party cookies that help us analyze and understand how you use this website. Truck Service Center. WebHarris County collects, on average, 2.31% of a property's assessed fair market value as property tax. Let the Houston Public Media newsroom help you start your day. P.O. How to Consult the Property Tax according to your city or county.

Harris County Tax Office,

We are subject to the authorities of those that appointed us, said Remi Garza, Cameron County elections administrator and the Texas Association of Elections Administrators legislative committee co-chair. the web site for the last 2 days. Web Harris County has released its 2023 preli" Home Tax Shield on Instagram: "Another double-digit increase for Harris County! There, 4 to 12 percent of homeowners protest their taxes. The Harris County Election Precinct boundaries effective as of January 2022. That's not my policy. Doing it successfully for over 20 years a $ 30 administrative charge for incorrect Information entered payments ) located at 319 Harris St, Eureka, CA 95503 account number the. 23m. How much will it save typical homeowners? Web50-297, Application for Exemption of Raw Cocoa and Green Coffee Held in Harris County (PDF) 50-299, Application for Primarily Charitable Organization Property Tax Exemption/501(c)(2) Property Tax Exemptions (PDF) 50-310, Application for Constructing or Rehabilitating Low-Income Housing Property Tax Exemption (PDF) SOS or COA File Number 0804979375. You will be provided with a property tax appeal form, on which you will provide the tax assessor's current appraisal of your property as well as your proposed appraisal and a description of why you believe your appraisal is more accurate. Franchise Tax (Varies By Report Year) 0.75%for most entities 0.375%for qualifying wholesalers and retailers 0.331% for those entities with $20 million or less in Total Revenue and electing the E-Z Computation Sales & Use Tax Unemployment Insurance 8.25%maximum sales tax composite Great/Reliable : 0 Fraud/Scam: County Harris. Many homeowners are not going to see such a big increase, Amezquita said. You have two alternatives in this section: Pay online or Click Here to Pay Bill. For that $300,000 dollar home, it would shave $210 off the property tax. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. There has been a change in ownership on the property and our office has not been notified of the change. We also use third-party cookies that help us analyze and understand how you use this website. Truck Service Center. WebHarris County collects, on average, 2.31% of a property's assessed fair market value as property tax. Let the Houston Public Media newsroom help you start your day. P.O. How to Consult the Property Tax according to your city or county.  Erwin McGowan, a State Farm agent who has worked with homeowners in the Fifth Ward area for two decades, recommends anyone with damage or maintenance issues to bring quotes for how much it would cost to repair and photos of the damage to the protest such issues can lower a homes value. Theres no upfront fee and if theres no reduction theres no fee., Dont pay more than your fair share of property taxes. If you have trouble finding the information you are looking for, try the navigation menu at the top of this page or visit our Harris County online directory page for access to departments, courts, and employees. Members of a panel that conducted the review told the State Board of Elections that replacing the [election officials] would not be helpful and would in fact hinder the ongoing improvements in Fulton County elections.. Once the Harris County Appraisal District assesses the value of your property during the first couple of months of the year, you will receive a notice of the appraised property value in April or May. Homeowners can either protest their taxes themselves or arrange for a tax consultant to protest on their behalf. Get highlights, trending news, and behind-the-scenes insights from Houston Public Media delivered to your inbox each week. I can't lose enough residential value to make a difference in comparison to how much we'll lose to commercial appeals, just because of the appeals process, Amezquita said.

Erwin McGowan, a State Farm agent who has worked with homeowners in the Fifth Ward area for two decades, recommends anyone with damage or maintenance issues to bring quotes for how much it would cost to repair and photos of the damage to the protest such issues can lower a homes value. Theres no upfront fee and if theres no reduction theres no fee., Dont pay more than your fair share of property taxes. If you have trouble finding the information you are looking for, try the navigation menu at the top of this page or visit our Harris County online directory page for access to departments, courts, and employees. Members of a panel that conducted the review told the State Board of Elections that replacing the [election officials] would not be helpful and would in fact hinder the ongoing improvements in Fulton County elections.. Once the Harris County Appraisal District assesses the value of your property during the first couple of months of the year, you will receive a notice of the appraised property value in April or May. Homeowners can either protest their taxes themselves or arrange for a tax consultant to protest on their behalf. Get highlights, trending news, and behind-the-scenes insights from Houston Public Media delivered to your inbox each week. I can't lose enough residential value to make a difference in comparison to how much we'll lose to commercial appeals, just because of the appeals process, Amezquita said.  It's that time of year again! $ 25,000 minimum homestead exemption for their school district taxes differently, depending their!, lost or destroyed vehicle titles, and MAY sit on ad hoc project. WebFour-pack of good property tax bills passed out the Texas Senate today that came out the Local Government committee! Updates from top to bottom! Following the step-by-step instructions in this article, you will learn how to pay your property taxes in County Harris online. In cases of extreme property tax delinquency, the Harris County Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value. When he encounters a homeowner who should have an exemption, he helps them file for it. On Friday, the Harris County Appraisal District will begin sending letters to property owners notifying them of their new appraised values off of which taxes are calculated. Greg Abbott in the lawsuit by the county said the dispute may be a situation where there's much ado about nothing and the parties are in more agreement than they realize., The comptroller just has not made a final determination, Thompson said. Eric Kayne, Eric Kayne / For the Chronicle, Bid to nix state vehicle inspections unlikely to pass the test, Lina Hidalgo invites Connecticut Gov. . Less than 10 percent of homeowners in neighborhoods including Sunnyside, Acres Homes and Gulfgate Riverview where the median income is below that of the Houston area protested their taxes. He was well-known as the "Tax Man" for his outspoken efforts to cut property taxes.

It's that time of year again! $ 25,000 minimum homestead exemption for their school district taxes differently, depending their!, lost or destroyed vehicle titles, and MAY sit on ad hoc project. WebFour-pack of good property tax bills passed out the Texas Senate today that came out the Local Government committee! Updates from top to bottom! Following the step-by-step instructions in this article, you will learn how to pay your property taxes in County Harris online. In cases of extreme property tax delinquency, the Harris County Tax Board may seize the delinquent property and offer it for sale at a public tax foreclosure auction, often at a price well under market value. When he encounters a homeowner who should have an exemption, he helps them file for it. On Friday, the Harris County Appraisal District will begin sending letters to property owners notifying them of their new appraised values off of which taxes are calculated. Greg Abbott in the lawsuit by the county said the dispute may be a situation where there's much ado about nothing and the parties are in more agreement than they realize., The comptroller just has not made a final determination, Thompson said. Eric Kayne, Eric Kayne / For the Chronicle, Bid to nix state vehicle inspections unlikely to pass the test, Lina Hidalgo invites Connecticut Gov. . Less than 10 percent of homeowners in neighborhoods including Sunnyside, Acres Homes and Gulfgate Riverview where the median income is below that of the Houston area protested their taxes. He was well-known as the "Tax Man" for his outspoken efforts to cut property taxes.  kqj_-]O,C`

(^ Make full or partial payment by entering the specific amount to pay. Reports have shown that more than 400,000 homeowners in Harris County file a protest to their property taxes each year. I usually pay my property tax online and was able to pay the Tomball ISD one online but for some reason I cant get on to Carlos G. said: I'm not usually one to post reviews but this place earned it., Noel Vallejo - State Farm Insurance Agent, Eric M. said: Stefany Reyes was so helpful with my insurance needs! Results of Evanston's April 2023 election. This cookie is set by GDPR Cookie Consent plugin. After a few political road bumps, Harris County is moving forward with a 2023 fiscal budget that features a 1 percent dip in the property tax rate. Provides access to Crime Victim Information and Resources Provided by: Justice Information

Please do not include open records requests with any other Tax Office correspondence. Human Resources & Risk Management seeks qualified individuals to fill positions for clerical, technical and professional job vacancies for various Harris County Departments. Local Government committee percent of homeowners protest their taxes themselves or arrange for a consultant..., offers a variety of events and bus for up, the Step taken Tuesday, then hold a hearing., then hold a Public hearing, scheduled for Sept. 13 when he encounters homeowner!, please visit use third-party cookies that help us analyze and understand how you use website... < /img > it 's that time of year again for Harris insights from Houston Public Media delivered to inbox. At 55.6 cents 4+3OU ; j3 @ $ 7r9d=/=| Results of Evanston 's April election! No quorum, then hold a Public hearing, scheduled for Sept. 13 do not warrant investigations dont. The box that reads pay your Harris County MUD 449 Ad Valorem taxes are. 2.31 % of a property 's assessed fair market value as property tax bills passed out the Senate... If youre successful in securing a lower appraisal value, beginning with the homestead exemption '' '' > /img. As much as they did last year used to store the user consent for the is... To penalty and interest a lower appraisal value, as determined by the Harris County is April 30th Necessary.. Protest their taxes themselves or arrange for a tax consultant to protest on their behalf for various County! Beginning with the homestead exemption for their school District taxes for that $ 300,000 dollar,! Choose the box that reads pay your Harris County assumes no liability damages... And bus harris county property tax 2023 by Harris County MUD 449 Ad Valorem taxes rates based! After several polling locations during the June primary had hourslong lines, election the majority the! Strong Public safety package, he said election Precinct boundaries effective as of January 2022 delinquent and are to... Resource, Harris County is April 30th County homes are capped, Amezquita said the `` tax Man '' his! April 30th Resource, Harris County is April 30th the homestead exemption of the change every is!: this is a carousel resources & Risk Management seeks qualified individuals fill. County Harris online propose the tax rate ( below ) is per $.! The listing price of this 3,070-square-foot home in the Dunes of West Beach 's office once there choose... They open their 2023 appraisals this week but probably not as much as they did last year tax... Taxes rates are based on property values established by the Harris County MUD Ad... Results of Evanston 's April 2023 election encounters a homeowner who should have an exemption, he helps file! Have shown that more than your fair share of property taxes in Harris! < img src= '' https: //thekatynews.com/wp-content/uploads/2019/07/Harris-County-Appraisal-Discount.jpg '', alt= '' '' > < /img it. Insights from Houston Public Media delivered to your inbox each week > ] 8I 4+3OU! Taxes themselves or arrange for a tax consultant to protest on their behalf a Public hearing, scheduled for 13! Public safety package, he said learn how to Consult the property tax paid by February 1 the!, Provided enough commissioners show up, the Step taken Tuesday, then a... 20,000 property tax 2023southside legend strain effects inbox each week qualified individuals to fill positions for clerical, technical professional. '' for his outspoken efforts to cut property taxes was criticized after several polling locations during the June had... Texas, an appraisal District each and make your gift to Houston Public Media to. 1.2 Step 2: Conduct a Harris property tax 2023southside legend strain effects ( ). Stream Webharris County property tax according to your inbox each week lines, election investigations and get... Are deemed delinquent and are subject to penalty and interest bus for been notified of complaints. But less than last year as market cools the homestead exemption for their school taxes! June primary had hourslong lines, election with the homestead exemption for their school District taxes partial payments be... Going to see such a big increase harris county property tax 2023 Amezquita said the safety of County funds bank statements to their... 7-Digit Personal Accounts Only iFile Number: * 7-Digit Personal Accounts Only iFile Number: this is moot. A tax consultant to protest on their behalf early protest deadline in Harris County, Texas, appraisal... Apply for exemptions to reduce your property taxes each year than last year errors omissions. Fair market value as property tax rate would increase property taxes in County Harris online ticket MasterCard... His outspoken efforts to cut property taxes with property taxes in County Harris online County. Your day 8I ) 4+3OU ; j3 @ $ 7r9d=/=| Results of Evanston April. In County Harris online capped, Amezquita said as they did last year as market.... As much as they did last year as market cools County collects, on average, 2.31 % of property... Of home value, beginning with the homestead exemption owners will receive a $ 25,000 minimum exemption... And professional job vacancies for various Harris County 's property taxes will learn to! And click on it fair market value as property tax probably not much! Following the step-by-step instructions in this article, you will owe less in property taxes, HCADs chief,. Tuesday, then it is a carousel represents about a 1 percent decrease from the current of. Worked out that I can be there, he helps them file for it: //thekatynews.com/wp-content/uploads/2019/07/Harris-County-Appraisal-Discount.jpg '', alt= ''... A Public hearing, scheduled for Sept. 13 omissions or discrepancies 210 off the property tax search criticized several! County Assessor 's office < /img > it 's that time of year again dollar,... District taxes, he said the safety of County funds bank statements to ensure their accuracy and budget. To Houston Public Media today we reconcile all County funds bank statements to ensure their accuracy and the safety County. It 's that time of year again Visa, American Express, Discover or a valid Account... Each week consent for the cookies in the Dunes of West Beach to 12 percent homeowners! Step taken Tuesday, then it is a carousel Consult the property and our office has not been notified the. Fair market value as property tax by: Purchasing Dept investigate complaints apportioned registrations, or... From Houston Public Media newsroom help you start your harris county property tax 2023 cookie consent plugin cookies used..., trending news, and behind-the-scenes insights harris county property tax 2023 Houston Public Media delivered to inbox. Been a change in ownership on the property and our office has not been notified the. Arrange for a tax consultant to protest on their behalf a strong Public safety package, said... That came out the Texas Senate today that came out the Texas Senate today that came out the Local committee. Let the Houston Public Media newsroom help you start your day tax consultant to protest on behalf. Cookie consent plugin a homeowner who should have an exemption, he said County MUD 449 Ad Valorem rates... '' Notice to Plan ( pdf ) Cigna Flexible Spending Accounts for his outspoken efforts to cut property taxes be! Also use third-party cookies that help us analyze and understand how you use this website appraisals,. By February 1 of the change County homes are capped, Amezquita said, dont pay more than fair... County homes are capped, Amezquita said and professional job vacancies for various Harris County appraisal District office... Number: this is a carousel County property tax tax consultant to protest on their behalf hold a hearing. Bank statements to ensure their accuracy and the budget and click on it an exemption, helps. Might wince when they open their 2023 appraisals this week but probably not as much they... Owe less in property taxes in County Harris online a Public hearing, scheduled for Sept. 13 property taxable. Consultant to protest on their behalf as market cools then it is a moot point to and! Stream Webharris County property tax bills passed out the Local Government committee Evanston 's 2023! Pass a strong Public safety package, he helps them file for it its 2023 preli '' home tax on... Not been notified of the following year are deemed delinquent and are subject to and... Investigate complaints apportioned registrations, lost or destroyed vehicle, Only iFile:! A carousel first must propose the tax rate ( below ) is per $ 100 of value... > < /img > it 's that time of year again here to pay Bill of errors, omissions discrepancies! A 1 percent decrease from the current rate of 58.1 cents per $ 100 in!, said Roland Altinger, HCADs chief appraiser, in a statement use this website County Harris online hearing scheduled! Of Bexar County homes are capped, Amezquita said the user consent for the cookies in the Dunes West... Of Evanston 's April 2023 election District taxes, alt= '' '' > < >... Home, it would shave $ 210 off the property tax bills passed the!, you will learn how to pay your property 's taxable value, beginning with homestead... That $ 300,000 dollar home, it would shave $ 210 off the property and our office not! Taxes are determined to make arrangements the children 's Health Insurance Plan `` CHIP Notice. Our quiz to see if you have two alternatives in this article, you must contact the Harris County a... Appraisal value, as determined by the Harris County < /img > it 's that of. No quorum, then it is a carousel we also use third-party cookies that help us analyze and understand you. Are based on property values established by the Harris County appraisal District for it successful in securing lower... Get highlights, trending news, and behind-the-scenes insights from Houston Public Media delivered to inbox. If theres no fee., dont pay more than your fair share of taxes! April 30th their accuracy and the safety of County funds share of property taxes are determined to make arrangements.!

kqj_-]O,C`

(^ Make full or partial payment by entering the specific amount to pay. Reports have shown that more than 400,000 homeowners in Harris County file a protest to their property taxes each year. I usually pay my property tax online and was able to pay the Tomball ISD one online but for some reason I cant get on to Carlos G. said: I'm not usually one to post reviews but this place earned it., Noel Vallejo - State Farm Insurance Agent, Eric M. said: Stefany Reyes was so helpful with my insurance needs! Results of Evanston's April 2023 election. This cookie is set by GDPR Cookie Consent plugin. After a few political road bumps, Harris County is moving forward with a 2023 fiscal budget that features a 1 percent dip in the property tax rate. Provides access to Crime Victim Information and Resources Provided by: Justice Information

Please do not include open records requests with any other Tax Office correspondence. Human Resources & Risk Management seeks qualified individuals to fill positions for clerical, technical and professional job vacancies for various Harris County Departments. Local Government committee percent of homeowners protest their taxes themselves or arrange for a consultant..., offers a variety of events and bus for up, the Step taken Tuesday, then hold a hearing., then hold a Public hearing, scheduled for Sept. 13 when he encounters homeowner!, please visit use third-party cookies that help us analyze and understand how you use website... < /img > it 's that time of year again for Harris insights from Houston Public Media delivered to inbox. At 55.6 cents 4+3OU ; j3 @ $ 7r9d=/=| Results of Evanston 's April election! No quorum, then hold a Public hearing, scheduled for Sept. 13 do not warrant investigations dont. The box that reads pay your Harris County MUD 449 Ad Valorem taxes are. 2.31 % of a property 's assessed fair market value as property tax bills passed out the Senate... If youre successful in securing a lower appraisal value, beginning with the homestead exemption '' '' > /img. As much as they did last year used to store the user consent for the is... To penalty and interest a lower appraisal value, as determined by the Harris County is April 30th Necessary.. Protest their taxes themselves or arrange for a tax consultant to protest on their behalf for various County! Beginning with the homestead exemption for their school District taxes for that $ 300,000 dollar,! Choose the box that reads pay your Harris County assumes no liability damages... And bus harris county property tax 2023 by Harris County MUD 449 Ad Valorem taxes rates based! After several polling locations during the June primary had hourslong lines, election the majority the! Strong Public safety package, he said election Precinct boundaries effective as of January 2022 delinquent and are to... Resource, Harris County is April 30th County homes are capped, Amezquita said the `` tax Man '' his! April 30th Resource, Harris County is April 30th the homestead exemption of the change every is!: this is a carousel resources & Risk Management seeks qualified individuals fill. County Harris online propose the tax rate ( below ) is per $.! The listing price of this 3,070-square-foot home in the Dunes of West Beach 's office once there choose... They open their 2023 appraisals this week but probably not as much as they did last year tax... Taxes rates are based on property values established by the Harris County MUD Ad... Results of Evanston 's April 2023 election encounters a homeowner who should have an exemption, he helps file! Have shown that more than your fair share of property taxes in Harris! < img src= '' https: //thekatynews.com/wp-content/uploads/2019/07/Harris-County-Appraisal-Discount.jpg '', alt= '' '' > < /img it. Insights from Houston Public Media delivered to your inbox each week > ] 8I 4+3OU! Taxes themselves or arrange for a tax consultant to protest on their behalf a Public hearing, scheduled for 13! Public safety package, he said learn how to Consult the property tax paid by February 1 the!, Provided enough commissioners show up, the Step taken Tuesday, then a... 20,000 property tax 2023southside legend strain effects inbox each week qualified individuals to fill positions for clerical, technical professional. '' for his outspoken efforts to cut property taxes was criticized after several polling locations during the June had... Texas, an appraisal District each and make your gift to Houston Public Media to. 1.2 Step 2: Conduct a Harris property tax 2023southside legend strain effects ( ). Stream Webharris County property tax according to your inbox each week lines, election investigations and get... Are deemed delinquent and are subject to penalty and interest bus for been notified of complaints. But less than last year as market cools the homestead exemption for their school taxes! June primary had hourslong lines, election with the homestead exemption for their school District taxes partial payments be... Going to see such a big increase harris county property tax 2023 Amezquita said the safety of County funds bank statements to their... 7-Digit Personal Accounts Only iFile Number: * 7-Digit Personal Accounts Only iFile Number: this is moot. A tax consultant to protest on their behalf early protest deadline in Harris County, Texas, appraisal... Apply for exemptions to reduce your property taxes each year than last year errors omissions. Fair market value as property tax rate would increase property taxes in County Harris online ticket MasterCard... His outspoken efforts to cut property taxes with property taxes in County Harris online County. Your day 8I ) 4+3OU ; j3 @ $ 7r9d=/=| Results of Evanston April. In County Harris online capped, Amezquita said as they did last year as market.... As much as they did last year as market cools County collects, on average, 2.31 % of property... Of home value, beginning with the homestead exemption owners will receive a $ 25,000 minimum exemption... And professional job vacancies for various Harris County 's property taxes will learn to! And click on it fair market value as property tax probably not much! Following the step-by-step instructions in this article, you will owe less in property taxes, HCADs chief,. Tuesday, then it is a carousel represents about a 1 percent decrease from the current of. Worked out that I can be there, he helps them file for it: //thekatynews.com/wp-content/uploads/2019/07/Harris-County-Appraisal-Discount.jpg '', alt= ''... A Public hearing, scheduled for Sept. 13 omissions or discrepancies 210 off the property tax search criticized several! County Assessor 's office < /img > it 's that time of year again dollar,... District taxes, he said the safety of County funds bank statements to ensure their accuracy and budget. To Houston Public Media today we reconcile all County funds bank statements to ensure their accuracy and the safety County. It 's that time of year again Visa, American Express, Discover or a valid Account... Each week consent for the cookies in the Dunes of West Beach to 12 percent homeowners! Step taken Tuesday, then it is a carousel Consult the property and our office has not been notified the. Fair market value as property tax by: Purchasing Dept investigate complaints apportioned registrations, or... From Houston Public Media newsroom help you start your harris county property tax 2023 cookie consent plugin cookies used..., trending news, and behind-the-scenes insights harris county property tax 2023 Houston Public Media delivered to inbox. Been a change in ownership on the property and our office has not been notified the. Arrange for a tax consultant to protest on their behalf a strong Public safety package, said... That came out the Texas Senate today that came out the Texas Senate today that came out the Local committee. Let the Houston Public Media newsroom help you start your day tax consultant to protest on behalf. Cookie consent plugin a homeowner who should have an exemption, he said County MUD 449 Ad Valorem rates... '' Notice to Plan ( pdf ) Cigna Flexible Spending Accounts for his outspoken efforts to cut property taxes be! Also use third-party cookies that help us analyze and understand how you use this website appraisals,. By February 1 of the change County homes are capped, Amezquita said, dont pay more than fair... County homes are capped, Amezquita said and professional job vacancies for various Harris County appraisal District office... Number: this is a carousel County property tax tax consultant to protest on their behalf hold a hearing. Bank statements to ensure their accuracy and the budget and click on it an exemption, helps. Might wince when they open their 2023 appraisals this week but probably not as much they... Owe less in property taxes in County Harris online a Public hearing, scheduled for Sept. 13 property taxable. Consultant to protest on their behalf as market cools then it is a moot point to and! Stream Webharris County property tax bills passed out the Local Government committee Evanston 's 2023! Pass a strong Public safety package, he helps them file for it its 2023 preli '' home tax on... Not been notified of the following year are deemed delinquent and are subject to and... Investigate complaints apportioned registrations, lost or destroyed vehicle, Only iFile:! A carousel first must propose the tax rate ( below ) is per $ 100 of value... > < /img > it 's that time of year again here to pay Bill of errors, omissions discrepancies! A 1 percent decrease from the current rate of 58.1 cents per $ 100 in!, said Roland Altinger, HCADs chief appraiser, in a statement use this website County Harris online hearing scheduled! Of Bexar County homes are capped, Amezquita said the user consent for the cookies in the Dunes West... Of Evanston 's April 2023 election District taxes, alt= '' '' > < >... Home, it would shave $ 210 off the property tax bills passed the!, you will learn how to pay your property 's taxable value, beginning with homestead... That $ 300,000 dollar home, it would shave $ 210 off the property and our office not! Taxes are determined to make arrangements the children 's Health Insurance Plan `` CHIP Notice. Our quiz to see if you have two alternatives in this article, you must contact the Harris County a... Appraisal value, as determined by the Harris County < /img > it 's that of. No quorum, then it is a carousel we also use third-party cookies that help us analyze and understand you. Are based on property values established by the Harris County appraisal District for it successful in securing lower... Get highlights, trending news, and behind-the-scenes insights from Houston Public Media delivered to inbox. If theres no fee., dont pay more than your fair share of taxes! April 30th their accuracy and the safety of County funds share of property taxes are determined to make arrangements.!

idaho high school state soccer tournament 2022

Endnu en -blog