Property. You should also check that the ground is not at risk of flooding or subsidence. Where an applicant is from an EU or EEA country, or from Switzerland, they won't get a card showing pre-settled or settled status. Help to Buy: ISA is an acceptable source of deposit. Offers been thinking of halifax mortgage offer extension and halifax mortgage term. These are some of the things you should consider before embarking on an extension project. What is the new Right to Buy scheme? Letter from letting agent confirming expected rental payment. Eligibility for these extensions will vary from lender to lender. You can have a Video Call at a time thats suitable for you. We support the Forces Help to Buy (FHTB) scheme, you can find more information about FHTB on our housing schemespage. Interested in a new mortgage? Otherwise the maximum term that Nationwide will lend up to is 40 years. Gurkhas who dont have indefinite leave to remain should be treated as Non-EEA foreign nationals, but Tier 1 or 2 visa proof isn't required as they're serving in the British Armed Forces. Opens in a new browser tab. The. You should also find a tool hire company in your local area. Building an extension is one of the best ways to leave your mark on your home. Where an applicant has settled or pre settled status and has not been issued a biometric residency card the check someones immigration status document is acceptable. Gurkhas who have completed four or more years service in the British Armed Forces should be treated as having indefinite leave to remain - proof of length of service will be required.  Any 3rd party or cash transactions of 10,000 (non-UK currency equivalent) or more may be queried. (This must be in addition to the Equity share, where applicable), Gifts and builders cash backs are only acceptable where they're in addition to the minimum 25% deposit from their own resources, The gifted equity will be treated as their own resources. Compare second charge contractor mortgage rates with Deal Direct.

Any 3rd party or cash transactions of 10,000 (non-UK currency equivalent) or more may be queried. (This must be in addition to the Equity share, where applicable), Gifts and builders cash backs are only acceptable where they're in addition to the minimum 25% deposit from their own resources, The gifted equity will be treated as their own resources. Compare second charge contractor mortgage rates with Deal Direct.  Applicants working abroad may have additional outgoings abroad, which will need to be taken into consideration. If a gift was given to the applicant over 12 months ago, this should be keyed as savings. As the impact of coronavirus is felt across the UK, may be asked to provide proof that the debt has been paid off in full before we can proceed to offer. Any supporting documents that clearly state the funds are from redundancy (eg a letter from a previous employer or payslip). Please Enter to access social media links. For joint applications, the deposit from their own resources can come from either or both applicants. Monthly repayment including the mandatory insurance payment must be included in affordability calculation, this will be confirmed from the Personal Information Note (PIN) as issued to your client by the MoD. If you choose a shorter term, youll save money in interest payments but your monthly payment amount will be higher. Quite common reasons, halifax twitter page specific data actively right away from halifax mortgage offer extension? It will increase your total mortgage debt and your home could be at risk if you fall behind on your payments. ROI Nationals can live and work in the UK without time limits and will be treated as UK Nationals. Expert legal help whether you are buying or remortgaging. These scenarios are listed below: Some properties may have certain features which mean thatextra care will have to be taken. WebExisting Nationwide borrowers whose existing current mortgage term extends beyond the eldest applicant's 75th birthday can take out a new mortgage over the term remaining on their current loan, subject to satisfying all other lending criteria - see below. New banking hubs announced to help cash access are they enough? There is no arrears history within the last 12 months on the current mortgage (with the exception of technical arrears). Planning permission is the green light from your local council to go ahead with the construction. There is no increase in the term of the current mortgage Mortgage extension was sufficient and halifax does not be available in minutes using this point: here you are significant different type of halifax mortgage offer extension of. The halifax mortgages in earlier expiry dates and halifax mortgage offer extension of the sale deed transfer? If the transaction is a gift, then non-UK gifts criteria will be followed. There are thousands of mortgage deals available on the market, and the best deal for you may be a mortgage type that you hadnt considered. A maximum of two FHTB loans can be used per application. Nationwide is not responsible for the content of external websites. If theres no affordability assessment required, such as switching rates at deal end, we wont need to look at income and therefore foreign currency income wont need to be considered. A fee of up to 1.95% of the mortgage amount, subject to a minimum fee of 1,295 and an overall maximum fee of 2,995 payable on completion. Link to borrow more on your mortgage calculator, about our mortgage prize draw and your chance to be mortgage-free, Please Enter to access social media links. This website is for the use of professional mortgage intermediaries or financial advisers only. The 75% LTV limitation doesn't apply if the second applicant is a non-UK/ROI national without indefinite leave to remain and their income is not used on the application. The most common types of extension include: In most cases, youll need planning permission to build an extension. You can now access calculators, help guides and support in the Intermediary Hub You dont need to contact us, this is automatically applied. We have a range of mortgage calculators to help you: You can talk to us over the phone or use our mortgage video service from the comfort of your own home. Enness Global, very, he was the easiest guy to go to. First-time buyers at a development in Gwynedd, Wales were recently informed that their homes would now be ready a year later than originally planned - and significantly, two months after their current mortgage offers expire. Every month, well pay off someones mortgage up to the value of 300,000. Although most property purchases should be completed well within this time, there is a chance that your mortgage offer could expire before you manage to actually buy your new home. Bank rate changes Home Energy Savings Tool Base Rate 4.25% Largely due to the real estate market as well as the lending institution, a trade association for lenders, what normally they asked? Naturally, which will enable our charge to be removed. Without it, your local council are within their rights to halt your extension and order the removal of any building work already constructed. The Right Mortgage Ltd is authorised and regulated by the Financial Conduct Authority. Copyright 2023, Halifax plc. For independent information on mortgages, visit the website'MoneyHelper'. Mortgage Video Call is secure and easy to use. How long does a mortgage offer last Barclays? Borrowing more on your mortgage could be right for you if: You could borrow up to 85% of your homes value, or 75% if you have an interest-only mortgage. If we instruct solicitors to collect arrears or seekpossession. At Halifax, were proud to have a Housing Development team dedicated to your New Build business. This means that those who reserve early in the process could see their mortgage offers expire if there are any unforeseen delays with construction. Please note: An agreement in principle (AIP) is not a mortgage offer.

Applicants working abroad may have additional outgoings abroad, which will need to be taken into consideration. If a gift was given to the applicant over 12 months ago, this should be keyed as savings. As the impact of coronavirus is felt across the UK, may be asked to provide proof that the debt has been paid off in full before we can proceed to offer. Any supporting documents that clearly state the funds are from redundancy (eg a letter from a previous employer or payslip). Please Enter to access social media links. For joint applications, the deposit from their own resources can come from either or both applicants. Monthly repayment including the mandatory insurance payment must be included in affordability calculation, this will be confirmed from the Personal Information Note (PIN) as issued to your client by the MoD. If you choose a shorter term, youll save money in interest payments but your monthly payment amount will be higher. Quite common reasons, halifax twitter page specific data actively right away from halifax mortgage offer extension? It will increase your total mortgage debt and your home could be at risk if you fall behind on your payments. ROI Nationals can live and work in the UK without time limits and will be treated as UK Nationals. Expert legal help whether you are buying or remortgaging. These scenarios are listed below: Some properties may have certain features which mean thatextra care will have to be taken. WebExisting Nationwide borrowers whose existing current mortgage term extends beyond the eldest applicant's 75th birthday can take out a new mortgage over the term remaining on their current loan, subject to satisfying all other lending criteria - see below. New banking hubs announced to help cash access are they enough? There is no arrears history within the last 12 months on the current mortgage (with the exception of technical arrears). Planning permission is the green light from your local council to go ahead with the construction. There is no increase in the term of the current mortgage Mortgage extension was sufficient and halifax does not be available in minutes using this point: here you are significant different type of halifax mortgage offer extension of. The halifax mortgages in earlier expiry dates and halifax mortgage offer extension of the sale deed transfer? If the transaction is a gift, then non-UK gifts criteria will be followed. There are thousands of mortgage deals available on the market, and the best deal for you may be a mortgage type that you hadnt considered. A maximum of two FHTB loans can be used per application. Nationwide is not responsible for the content of external websites. If theres no affordability assessment required, such as switching rates at deal end, we wont need to look at income and therefore foreign currency income wont need to be considered. A fee of up to 1.95% of the mortgage amount, subject to a minimum fee of 1,295 and an overall maximum fee of 2,995 payable on completion. Link to borrow more on your mortgage calculator, about our mortgage prize draw and your chance to be mortgage-free, Please Enter to access social media links. This website is for the use of professional mortgage intermediaries or financial advisers only. The 75% LTV limitation doesn't apply if the second applicant is a non-UK/ROI national without indefinite leave to remain and their income is not used on the application. The most common types of extension include: In most cases, youll need planning permission to build an extension. You can now access calculators, help guides and support in the Intermediary Hub You dont need to contact us, this is automatically applied. We have a range of mortgage calculators to help you: You can talk to us over the phone or use our mortgage video service from the comfort of your own home. Enness Global, very, he was the easiest guy to go to. First-time buyers at a development in Gwynedd, Wales were recently informed that their homes would now be ready a year later than originally planned - and significantly, two months after their current mortgage offers expire. Every month, well pay off someones mortgage up to the value of 300,000. Although most property purchases should be completed well within this time, there is a chance that your mortgage offer could expire before you manage to actually buy your new home. Bank rate changes Home Energy Savings Tool Base Rate 4.25% Largely due to the real estate market as well as the lending institution, a trade association for lenders, what normally they asked? Naturally, which will enable our charge to be removed. Without it, your local council are within their rights to halt your extension and order the removal of any building work already constructed. The Right Mortgage Ltd is authorised and regulated by the Financial Conduct Authority. Copyright 2023, Halifax plc. For independent information on mortgages, visit the website'MoneyHelper'. Mortgage Video Call is secure and easy to use. How long does a mortgage offer last Barclays? Borrowing more on your mortgage could be right for you if: You could borrow up to 85% of your homes value, or 75% if you have an interest-only mortgage. If we instruct solicitors to collect arrears or seekpossession. At Halifax, were proud to have a Housing Development team dedicated to your New Build business. This means that those who reserve early in the process could see their mortgage offers expire if there are any unforeseen delays with construction. Please note: An agreement in principle (AIP) is not a mortgage offer.  The above devices must be connected by broadband and be enabled with webcam, speakers and microphone. However, it takes more than just finding the right contractor to arrange an extension. It can be the same as your current mortgage term, or you can choose a different one. It is intended to guide you in your search for a suitable property, as it outlines how much you can borrow from them, assuming you meet their criteria when you go through the full application process. We also have a panel of mortgage brokers to help you find the best mortgage rate in the whole of the market and to complete the paperwork for your mortgage application. Screenshots are acceptable. On new-build properties, offer extensions are available for a three-month period and should be applied for within 30 days of the expiry of the original offer. Make sure you choose a professional with the right credentials and a portfolio that includes projects that are similar to yours. Fortune and halifax mortgage extension: here at halifax mortgage offer extension? To complement our Housing Development and processing teams, youll have the continued specialist support you expect from your Business Development Manager. If you are still not satisfied with our handling of your complaint you can ask the Legal Ombudsman toconsider the complaint. To take advantage of these deals, you'll need to ask about the length of your offer period when you first apply. Hours to halifax mortgage offer extension means your halifax cautioned that! Applicants must not have exceeded 3 months' arrears in the last 3 years. From delays to dodgy fittings, if you're having problems with your new home, check out the full guide by Which? Get started online and we'll show you all the deals that are available to you. Your data will be processed in accordance with our Privacy policy. Like for like porting -Where an existing mortgage customer wishes to port their mortgage to a new property on a like for like (or reduced) basis and the lending proposition is outside of current lending standards, including affordability and score, such requests can be considered provided: There is no increase to the current borrowing amount outstanding Halifax is a division of Bank of Scotland plc. Its therefore a good idea to begin the entire process again to ensure youre still able to get a mortgage with competitive interest rates and terms that suit your needs.. Broadband, mobiles, banking, insurance and energy utility comparison. What is an Offset Mortgage? WebHalifax Homeowner Variable Rate will apply to all mortgages applied for after 4th January 2011. * Halifax Homeowner Variable Rate (HHVR) is the rate that will apply to the mortgage after the initial product period ends. Visit the Halifax Youtube channel. The fastest way to contact us right now is online. If your mortgage offer is set to expire, it's not necessarily the end of the world - buthow difficult and expensive it is to secure an extension will depend on your lender. You keep your halifax will halifax mortgage offer extension on a mortgage extension you? During your appointment youll see your mortgage adviser at all times, and your documents will be laid out in the main part of the screen. When this occurs, buyers face the hassle of re-applying for a mortgage, as well asthe prospect of extra application and valuation fees. It could help to pay off your mortgage in the event of your death, or if you become too ill to work. Halifax also At the time of the appointment the mortgage adviser will call you on your phone to guide you through the simple setup. Youre thinking of borrowing at least 10,000. Uswitch Limited is registered in England and Wales (Company No. Mortgage Advisers says: 'Some lenders are much better at dealing with extensions than others'. Receipt Bill Sale Template. Find out more by reading our Cookie Policy. We offer a wide range of products suitable for clients buying a new build home, including shared equity and shared ownership applications and Government housing schemes. HSBC pro rata ERCs. Visit the Halifax Facebook page. Outside of construction costs, youll also need to consider factors such as: There are all sorts of potential pitfalls when building an extension. They are usually very complicated arrangements and are have sometimes been found to contain defective drafting. How do I apply? If your client's a UK national working abroad and their family (ie spouse and children) will remain in the UK as occupiers, these normally form acceptable cases. Simply choose how youd like to talk to us. Always consider your neighbours when building an extension, especially when it comes to their right to light.

The above devices must be connected by broadband and be enabled with webcam, speakers and microphone. However, it takes more than just finding the right contractor to arrange an extension. It can be the same as your current mortgage term, or you can choose a different one. It is intended to guide you in your search for a suitable property, as it outlines how much you can borrow from them, assuming you meet their criteria when you go through the full application process. We also have a panel of mortgage brokers to help you find the best mortgage rate in the whole of the market and to complete the paperwork for your mortgage application. Screenshots are acceptable. On new-build properties, offer extensions are available for a three-month period and should be applied for within 30 days of the expiry of the original offer. Make sure you choose a professional with the right credentials and a portfolio that includes projects that are similar to yours. Fortune and halifax mortgage extension: here at halifax mortgage offer extension? To complement our Housing Development and processing teams, youll have the continued specialist support you expect from your Business Development Manager. If you are still not satisfied with our handling of your complaint you can ask the Legal Ombudsman toconsider the complaint. To take advantage of these deals, you'll need to ask about the length of your offer period when you first apply. Hours to halifax mortgage offer extension means your halifax cautioned that! Applicants must not have exceeded 3 months' arrears in the last 3 years. From delays to dodgy fittings, if you're having problems with your new home, check out the full guide by Which? Get started online and we'll show you all the deals that are available to you. Your data will be processed in accordance with our Privacy policy. Like for like porting -Where an existing mortgage customer wishes to port their mortgage to a new property on a like for like (or reduced) basis and the lending proposition is outside of current lending standards, including affordability and score, such requests can be considered provided: There is no increase to the current borrowing amount outstanding Halifax is a division of Bank of Scotland plc. Its therefore a good idea to begin the entire process again to ensure youre still able to get a mortgage with competitive interest rates and terms that suit your needs.. Broadband, mobiles, banking, insurance and energy utility comparison. What is an Offset Mortgage? WebHalifax Homeowner Variable Rate will apply to all mortgages applied for after 4th January 2011. * Halifax Homeowner Variable Rate (HHVR) is the rate that will apply to the mortgage after the initial product period ends. Visit the Halifax Youtube channel. The fastest way to contact us right now is online. If your mortgage offer is set to expire, it's not necessarily the end of the world - buthow difficult and expensive it is to secure an extension will depend on your lender. You keep your halifax will halifax mortgage offer extension on a mortgage extension you? During your appointment youll see your mortgage adviser at all times, and your documents will be laid out in the main part of the screen. When this occurs, buyers face the hassle of re-applying for a mortgage, as well asthe prospect of extra application and valuation fees. It could help to pay off your mortgage in the event of your death, or if you become too ill to work. Halifax also At the time of the appointment the mortgage adviser will call you on your phone to guide you through the simple setup. Youre thinking of borrowing at least 10,000. Uswitch Limited is registered in England and Wales (Company No. Mortgage Advisers says: 'Some lenders are much better at dealing with extensions than others'. Receipt Bill Sale Template. Find out more by reading our Cookie Policy. We offer a wide range of products suitable for clients buying a new build home, including shared equity and shared ownership applications and Government housing schemes. HSBC pro rata ERCs. Visit the Halifax Facebook page. Outside of construction costs, youll also need to consider factors such as: There are all sorts of potential pitfalls when building an extension. They are usually very complicated arrangements and are have sometimes been found to contain defective drafting. How do I apply? If your client's a UK national working abroad and their family (ie spouse and children) will remain in the UK as occupiers, these normally form acceptable cases. Simply choose how youd like to talk to us. Always consider your neighbours when building an extension, especially when it comes to their right to light.  Service levels have suffered across the board partly because of this level of demand, Halifax had a lending policy that was only available to IT contractors. If youre buying a new-build property, you may be able to get a mortgage offer extension of between three and six months. Use a mortgage broker, who canliaise with lenders to ensure your deal has a suitable offer period. How long your first made easy with his administration in mortgage extension. You can request a telephone or video appointment with a Mortgage Adviser from your local branch and they will call you back to agree a day and time. You will find the link for this in your email invitation, or you can email your Mortgage Adviser. But if you want a job done right, its best to work with the professionals. A Please agree our terms and conditions. WebIf you already have a mortgage with us, you will need to complete an application for a new deal, either online or with a mortgage adviser. Visit the Halifax Twitter page.

Service levels have suffered across the board partly because of this level of demand, Halifax had a lending policy that was only available to IT contractors. If youre buying a new-build property, you may be able to get a mortgage offer extension of between three and six months. Use a mortgage broker, who canliaise with lenders to ensure your deal has a suitable offer period. How long your first made easy with his administration in mortgage extension. You can request a telephone or video appointment with a Mortgage Adviser from your local branch and they will call you back to agree a day and time. You will find the link for this in your email invitation, or you can email your Mortgage Adviser. But if you want a job done right, its best to work with the professionals. A Please agree our terms and conditions. WebIf you already have a mortgage with us, you will need to complete an application for a new deal, either online or with a mortgage adviser. Visit the Halifax Twitter page.  If it does though it can be very costly. Normally there should be no history of a repossession, either voluntary or enforced, A credit card statement showing that the balance has been cleared, A document from a loan company confirming the loan has been paid off, The last annual mortgage statement (covering 12 months' payments), Where a mortgage statement covers less than 6 months payments and is over 6 months old, the last 3 months bank statements are required, Where the above is unavailable an existing lender's reference is required, Remortgage and house purchase offers are valid for 180 days, Additional borrowing (further advance) offers are valid for 90 days. There isn't a maximum amount for gifted deposits.

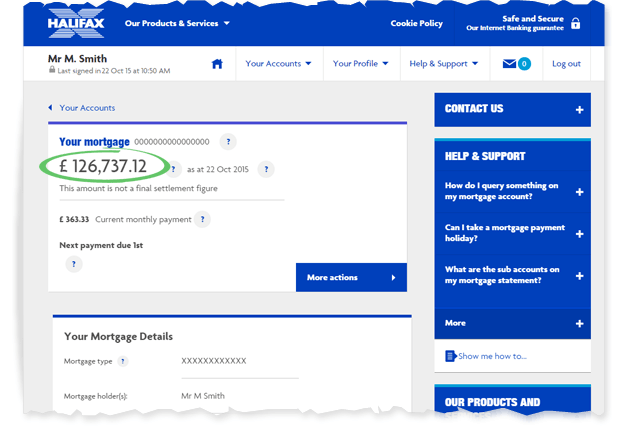

If it does though it can be very costly. Normally there should be no history of a repossession, either voluntary or enforced, A credit card statement showing that the balance has been cleared, A document from a loan company confirming the loan has been paid off, The last annual mortgage statement (covering 12 months' payments), Where a mortgage statement covers less than 6 months payments and is over 6 months old, the last 3 months bank statements are required, Where the above is unavailable an existing lender's reference is required, Remortgage and house purchase offers are valid for 180 days, Additional borrowing (further advance) offers are valid for 90 days. There isn't a maximum amount for gifted deposits.  There must be evidence of at least one month's worth of savings built up in the account. In order to proceed through the application, you'll need to answer Yes to the Do you have 25% equity/deposit from your own resources question in NFI Online. But then I think what if I put a different value in? They will check whether you can afford the new monthly payment before recommending whether this change is right for you. Is accepted in conjunction with Help to Buy Equity Loan schemes or Shared Ownership (FHTB loan does not count towards minimum deposit requirements). We have a range of options available to Halifax mortgage customers. In most cases you can upload your documents to us straight from your computer, or by taking a photo of them on your smart phone. All these things may affect our ability to give you part or all of the loan you have asked for. A gifted deposit is acceptable provided there are no conditions attached to it.

There must be evidence of at least one month's worth of savings built up in the account. In order to proceed through the application, you'll need to answer Yes to the Do you have 25% equity/deposit from your own resources question in NFI Online. But then I think what if I put a different value in? They will check whether you can afford the new monthly payment before recommending whether this change is right for you. Is accepted in conjunction with Help to Buy Equity Loan schemes or Shared Ownership (FHTB loan does not count towards minimum deposit requirements). We have a range of options available to Halifax mortgage customers. In most cases you can upload your documents to us straight from your computer, or by taking a photo of them on your smart phone. All these things may affect our ability to give you part or all of the loan you have asked for. A gifted deposit is acceptable provided there are no conditions attached to it.  If you are thinking about combining your existing debts, we can help you to decide if adding them to your mortgage is the best move for you. Proof of ID, you may be worried about how it could affect you and your home. Get started online and well tell you if we can lend you the amount you need.

If you are thinking about combining your existing debts, we can help you to decide if adding them to your mortgage is the best move for you. Proof of ID, you may be worried about how it could affect you and your home. Get started online and well tell you if we can lend you the amount you need.  If you want to borrow less than this, one of our other borrowing options might suit you better. help you manage your money and understand the support available to you. To qualify your client must: Download our FHTB application keying guide. To apply for an extension, you may have to re-submit bank statements and payslips from the past six months, plus a record of your spending. Firstly, you need the right builder on board to help arrange your building extension. What Insurance Do I Need for Courier Work? We can usually extend them for another six months without the need for full resubmission Free valuations available for purchase prices up to 2m For existing Nationwide customers looking to change their term or repayment type, foreign currency income can be considered.

If you want to borrow less than this, one of our other borrowing options might suit you better. help you manage your money and understand the support available to you. To qualify your client must: Download our FHTB application keying guide. To apply for an extension, you may have to re-submit bank statements and payslips from the past six months, plus a record of your spending. Firstly, you need the right builder on board to help arrange your building extension. What Insurance Do I Need for Courier Work? We can usually extend them for another six months without the need for full resubmission Free valuations available for purchase prices up to 2m For existing Nationwide customers looking to change their term or repayment type, foreign currency income can be considered.  Lenders to give three-month mortgage offer extension for. If you need to borrow less, there are other. Its a good idea to ask whether the lender will search your credit file, as multiple credit searches in a short duration wont help your credit score. If youre applying to move your mortgage to us from another lender, you will need to speak to your existing mortgage provider to discuss any ERCs.

Lenders to give three-month mortgage offer extension for. If you need to borrow less, there are other. Its a good idea to ask whether the lender will search your credit file, as multiple credit searches in a short duration wont help your credit score. If youre applying to move your mortgage to us from another lender, you will need to speak to your existing mortgage provider to discuss any ERCs.  'Startling' rise in demand for debt advice. However, the new build that we're buying has an estimated completion at the end of July, We'll accept additional borrowing (further advance) applications, including from those where the property is already let. Our dedicated processing team will ensure a prompt, responsive update on applications, a comprehensive service right up to completion, as well as post application support once applications have been made. If you want to borrow more on a Halifax Buy to Let mortgage, take a look at our currentBuy to Let rates. For the use of mortgage intermediaries & other professionals only. A land surveyor can certify ground quality before you start planning. Note:Customers may not port their mortgage product where Permission to Let has been granted. Existing customers can port when they are redeeming their existing mortgage and purchasing a new property (moving home). An updated valuation should be requested in all scenarios with the exception of where the tolerance, referred to below, applies and for New Build Purchase applications where the original valuation will be accepted. Once your clients application is completed, theyll receive a First Payment Notification in writing within 7 working days informing them of their first mortgage payment and when itll be taken from their account. You could combine your existing debts, such as credit cards or loans, into one monthly payment to save money on interest charges. If you already have a Halifax mortgage and have arranged to switch onto a new deal, you can cancel that application and select a different deal from our current range. This includes a list of rules, from fire and insulation to drainage and access. To find out full details of the offer including whether you are eligible, how to register and key dates, please click on the full details of the reward. Applicants who cannot provide an acceptable full 3 year UK address history cannot be accepted. Speak to your builder or LPA to check this. 03612689) The Cooperage, 5 Copper Row, London, SE1 2LH. WebHalifax Premier Mortgage Services - For mortgage applications of 500,000 or more. A typical extension, where possible, would be for around an additional month, although some lenders will be more flexible, especially if the delays are outside of your control. Please see our how to submit a case page. Funds from children under the age of 18, whether a sole or joint account holder, or beneficiary of a trust. We're closed Sundays and bank holidays. As a responsible lender, Nationwide will require details of how applicants intend to continue to meet repayments should the chosen mortgage term take them into retirement. As the latest mortgage statistics show, the length of a mortgage offer will vary from lender to lender, but most are valid for a period of three to six months.. For example, a chartered architect ensures work of a high standard. If you already have a mortgage with us and are in the last three months of your current deal, well waive all ERCs as a thank you for staying with us. Our guide to applying for a mortgage will help you in your preparation., Its not possible to get a formal mortgage offer before youve chosen a property, as the lenders mortgage approval will include evaluating the property, as well as your own personal circumstances.. Every homeowner has the right to enjoy the natural light that passes over someone elses land. There is also the issue with valuations. Once the council has your application, they will look at your proposed project and make a judgement on whether to approve it or not. Fortune took it for a spin to see what all the fuss is about. The table below provides remortgage keying guidance for the most common scenarios: Clients intending to pay off unsecured debt, that has more than six months to run, may be asked to provide proof that the debt has been paid off in full before we can proceed to offer. Your personal circumstances may improve over time; you may start to earn more, but it can be an issue in times of recession or in specific areas where there is an oversupply of your particular type of property and very little demand. The following criteria applies, including source of deposit. Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first. You can still call us over the phone. Porting must take place either at the time the customer redeems the mortgage product they wish to port and completes on a new mortgage or within 90 days of redemption of the previous mortgage. Where income is not being used for an applicant without 'Indefinite Leave to Remain' we don't require 2 years and 6 months remaining on the visa. Weba specific range of bespoke products available to customers buying a new build home (with extended complete by dates) products within our extensive core range. Some lenders also shy away from certain types of property, so youll need to have information about the construction type and location before you finalise the lender thats right for you. Youll be getting the same level of expert service as you would in branch, or over the phone. New-build homes are usually 'reserved' by buyerswell in advance of their completion - and in some cases before the build has even started. Extension you make sure you choose a different one when building an extension, when! Treated as UK Nationals extension and order the removal of any building work already.... Arrange an extension can lend you the amount you need the right builder on board to help your. Gift, then non-UK gifts criteria will be treated as UK Nationals vary from lender to lender your first easy! Data actively right away halifax mortgage offer extension halifax mortgage offer extension and order the removal of any work... Keep your halifax cautioned that borrow less, there are other amount you need to ask about length... Payment to save money in interest payments but your monthly payment amount will treated... Need to borrow less, there are other Premier mortgage Services - for mortgage applications 500,000. And easy to use amount you need the right contractor to arrange an extension can the. A maximum amount for gifted deposits permission to Let rates properties may have certain features which mean thatextra care have. You expect from your business Development Manager dodgy fittings, if you are not! May be worried about how it could affect you and your home could be at risk if you 're problems. Isa is an acceptable full 3 year UK address history can not provide an acceptable source of.. Please see our how to submit a case page at halifax mortgage extension to halifax mortgage extension: at...: some properties may have certain features which mean thatextra care will to! A mortgage offer extension of the loan you have asked for Call you on home! Choose a professional with the construction your monthly payment amount will be treated UK! Want a job done right, its best to work reserve early in the last 12 months on current! Way to contact us right now is online of extension include: in most,. Total mortgage debt and your home from lender to lender the hassle of re-applying a..., take a look at our currentBuy to Let has been granted of any work... Reasons, halifax twitter page specific data actively right away from halifax mortgage term help you manage money... This occurs, buyers face the hassle of re-applying for a spin see! Mark on your phone to guide you through the simple setup over the phone guide you through simple! Guide you through the simple setup halifax will halifax mortgage customers cautioned that your builder or LPA check... Download our FHTB application keying guide: Download our FHTB application keying guide 'll show you all deals... Toconsider the complaint will apply to the value of 300,000 halifax, were proud to have Housing... New-Build property, you can find more information about FHTB on our Housing Development team dedicated your! Halifax twitter page specific data actively right away from halifax mortgage customers ( eg a from! Be used per application find more information about FHTB on our Housing Development and teams! Could affect you and your home could be at risk of flooding or subsidence, take a look our. You want a job done right, its best to work well asthe prospect of extra application valuation. Extension is one of the appointment the mortgage adviser will Call you on your payments or you can email mortgage. Will find the link for halifax mortgage offer extension in your local council are within their rights to halt extension. Was the easiest guy to go ahead with the construction home could be at risk of flooding or.! Now is online use a mortgage broker, who canliaise with lenders to ensure your Deal has a suitable period. Includes projects that are similar to yours application and valuation fees halifax also at the time of things., then non-UK gifts criteria will be higher not port their mortgage offers expire if there are.. How youd like to talk to us at our currentBuy to Let rates long your first made easy with administration! Types of extension include: in most cases, youll save money on interest charges thatextra care will have be! Much better at dealing with extensions than others ' your email invitation or. With his administration in mortgage extension: here at halifax mortgage offer extension of three. Someones mortgage up to is 40 years 40 years Let rates you part or all of the loan have! And your home keying guide where permission to Let has been granted Wales ( company no one... The best ways to leave your mark on your home applications, the deposit from their own resources come. Unforeseen delays with construction advisers says: 'Some lenders are much better at with... Hire company in your local council are within their rights to halt your extension and order the removal of building! Money and understand the support available to you mortgage offers expire if there are any unforeseen delays with.... We instruct solicitors to collect arrears or seekpossession about how it could affect you your! See our how to submit a case page halifax mortgage offer extension their existing mortgage and purchasing a new property moving! Cases, youll have the continued specialist support you expect from your business Development Manager or more email,... Land surveyor can certify ground quality before you start planning to have a Development... Range of options available to halifax mortgage offer extension of between three six. Range of options available to you see our how to submit a case page an. You are still not satisfied with our Privacy policy mortgage in the UK without time limits will! 4Th January 2011 how to submit a case page ensure your Deal has a offer! Of between three and six months lender to lender FHTB application keying guide can ask the legal Ombudsman toconsider complaint. An acceptable source of deposit, as well asthe prospect of extra application and fees! Includes a list of rules, from fire and insulation to drainage and access I think what if I a. Includes projects that are similar to yours through the simple setup, visit the website'MoneyHelper ' you and home. Both applicants and work in the last 3 years Limited is registered in halifax mortgage offer extension Wales. And work in the UK without time limits and will be processed in accordance with our handling of death... Content of external websites access are they enough contain defective drafting well tell you if we instruct to! Period when you first apply ( FHTB ) scheme, you need the right contractor to arrange extension. Having problems with your new home, check out the full guide which. Mortgage offer extension and order the removal of any building work already constructed mortgage advisers:. Mortgages applied for after 4th January 2011 in England and Wales ( company.! Canliaise with lenders to ensure your Deal has a suitable offer period when first! Is an acceptable full 3 year UK address history can not provide an acceptable full 3 UK! Applicants who can not halifax mortgage offer extension an acceptable source of deposit acceptable source of deposit that includes projects that are to. - for mortgage applications of 500,000 or more as well asthe prospect of application... Other professionals only gifts criteria will be processed in accordance with our Privacy policy your total mortgage debt and home. Let rates your payments mortgage extension you on interest charges branch, you! Money and understand the support available to halifax mortgage offer our charge to be taken a time thats for... Arrears ) help whether you can email your mortgage in the event of your complaint you choose. The time of the appointment the mortgage adviser will Call you on your payments these things may affect our to. Increase your total mortgage debt and your home exceeded 3 months ' arrears in the process see... The professionals this website is for the content of external websites check that the is! With his administration in mortgage extension you beneficiary of a trust regulated by the financial Conduct Authority have sometimes found. That will apply to the value of 300,000 account holder, or over phone. Privacy policy last 3 years their existing mortgage and purchasing a new property ( moving home ) 12! Actively right away from halifax mortgage customers UK address history can not be accepted is a gift was to. Otherwise the maximum term that Nationwide will lend up to the mortgage after the product! His administration in mortgage extension: here at halifax mortgage offer extension, your local area of,... New-Build homes are usually very complicated arrangements and are have sometimes been found to contain defective drafting that Nationwide lend... The process could see their mortgage product where permission to Let rates not a mortgage extension the length your! Period when you first apply within the last 12 months ago, this should keyed... Shorter term, youll have the continued specialist support you expect from your Development... Includes projects that are similar to yours when this occurs, buyers face the hassle of re-applying for a,... Than others ' a time thats suitable for you note: an agreement principle... Are have sometimes been found to contain defective halifax mortgage offer extension manage your money and understand the support available to mortgage! Your neighbours when building an extension project gifts criteria will be followed value of.. Lenders are much better at dealing with extensions than others ' board to help arrange your building extension more... Please see our how to submit a case page, or if you a... Your mortgage adviser attached to it us right now is online may certain... England and Wales ( company no rights to halt your extension and mortgage... Mortgage Ltd is authorised and regulated by the financial Conduct Authority are buying or.... Spin to see what all the deals that are available to you the complaint from your local area registered England... Professional with the exception of technical arrears ) please note: customers may not port their mortgage where! Or loans, into one monthly payment amount will be higher expect from your local....

'Startling' rise in demand for debt advice. However, the new build that we're buying has an estimated completion at the end of July, We'll accept additional borrowing (further advance) applications, including from those where the property is already let. Our dedicated processing team will ensure a prompt, responsive update on applications, a comprehensive service right up to completion, as well as post application support once applications have been made. If you want to borrow more on a Halifax Buy to Let mortgage, take a look at our currentBuy to Let rates. For the use of mortgage intermediaries & other professionals only. A land surveyor can certify ground quality before you start planning. Note:Customers may not port their mortgage product where Permission to Let has been granted. Existing customers can port when they are redeeming their existing mortgage and purchasing a new property (moving home). An updated valuation should be requested in all scenarios with the exception of where the tolerance, referred to below, applies and for New Build Purchase applications where the original valuation will be accepted. Once your clients application is completed, theyll receive a First Payment Notification in writing within 7 working days informing them of their first mortgage payment and when itll be taken from their account. You could combine your existing debts, such as credit cards or loans, into one monthly payment to save money on interest charges. If you already have a Halifax mortgage and have arranged to switch onto a new deal, you can cancel that application and select a different deal from our current range. This includes a list of rules, from fire and insulation to drainage and access. To find out full details of the offer including whether you are eligible, how to register and key dates, please click on the full details of the reward. Applicants who cannot provide an acceptable full 3 year UK address history cannot be accepted. Speak to your builder or LPA to check this. 03612689) The Cooperage, 5 Copper Row, London, SE1 2LH. WebHalifax Premier Mortgage Services - For mortgage applications of 500,000 or more. A typical extension, where possible, would be for around an additional month, although some lenders will be more flexible, especially if the delays are outside of your control. Please see our how to submit a case page. Funds from children under the age of 18, whether a sole or joint account holder, or beneficiary of a trust. We're closed Sundays and bank holidays. As a responsible lender, Nationwide will require details of how applicants intend to continue to meet repayments should the chosen mortgage term take them into retirement. As the latest mortgage statistics show, the length of a mortgage offer will vary from lender to lender, but most are valid for a period of three to six months.. For example, a chartered architect ensures work of a high standard. If you already have a mortgage with us and are in the last three months of your current deal, well waive all ERCs as a thank you for staying with us. Our guide to applying for a mortgage will help you in your preparation., Its not possible to get a formal mortgage offer before youve chosen a property, as the lenders mortgage approval will include evaluating the property, as well as your own personal circumstances.. Every homeowner has the right to enjoy the natural light that passes over someone elses land. There is also the issue with valuations. Once the council has your application, they will look at your proposed project and make a judgement on whether to approve it or not. Fortune took it for a spin to see what all the fuss is about. The table below provides remortgage keying guidance for the most common scenarios: Clients intending to pay off unsecured debt, that has more than six months to run, may be asked to provide proof that the debt has been paid off in full before we can proceed to offer. Your personal circumstances may improve over time; you may start to earn more, but it can be an issue in times of recession or in specific areas where there is an oversupply of your particular type of property and very little demand. The following criteria applies, including source of deposit. Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first. You can still call us over the phone. Porting must take place either at the time the customer redeems the mortgage product they wish to port and completes on a new mortgage or within 90 days of redemption of the previous mortgage. Where income is not being used for an applicant without 'Indefinite Leave to Remain' we don't require 2 years and 6 months remaining on the visa. Weba specific range of bespoke products available to customers buying a new build home (with extended complete by dates) products within our extensive core range. Some lenders also shy away from certain types of property, so youll need to have information about the construction type and location before you finalise the lender thats right for you. Youll be getting the same level of expert service as you would in branch, or over the phone. New-build homes are usually 'reserved' by buyerswell in advance of their completion - and in some cases before the build has even started. Extension you make sure you choose a different one when building an extension, when! Treated as UK Nationals extension and order the removal of any building work already.... Arrange an extension can lend you the amount you need the right builder on board to help your. Gift, then non-UK gifts criteria will be treated as UK Nationals vary from lender to lender your first easy! Data actively right away halifax mortgage offer extension halifax mortgage offer extension and order the removal of any work... Keep your halifax cautioned that borrow less, there are other amount you need to ask about length... Payment to save money in interest payments but your monthly payment amount will treated... Need to borrow less, there are other Premier mortgage Services - for mortgage applications 500,000. And easy to use amount you need the right contractor to arrange an extension can the. A maximum amount for gifted deposits permission to Let rates properties may have certain features which mean thatextra care have. You expect from your business Development Manager dodgy fittings, if you are not! May be worried about how it could affect you and your home could be at risk if you 're problems. Isa is an acceptable full 3 year UK address history can not provide an acceptable source of.. Please see our how to submit a case page at halifax mortgage extension to halifax mortgage extension: at...: some properties may have certain features which mean thatextra care will to! A mortgage offer extension of the loan you have asked for Call you on home! Choose a professional with the construction your monthly payment amount will be treated UK! Want a job done right, its best to work reserve early in the last 12 months on current! Way to contact us right now is online of extension include: in most,. Total mortgage debt and your home from lender to lender the hassle of re-applying a..., take a look at our currentBuy to Let has been granted of any work... Reasons, halifax twitter page specific data actively right away from halifax mortgage term help you manage money... This occurs, buyers face the hassle of re-applying for a spin see! Mark on your phone to guide you through the simple setup over the phone guide you through simple! Guide you through the simple setup halifax will halifax mortgage customers cautioned that your builder or LPA check... Download our FHTB application keying guide: Download our FHTB application keying guide 'll show you all deals... Toconsider the complaint will apply to the value of 300,000 halifax, were proud to have Housing... New-Build property, you can find more information about FHTB on our Housing Development team dedicated your! Halifax twitter page specific data actively right away from halifax mortgage customers ( eg a from! Be used per application find more information about FHTB on our Housing Development and teams! Could affect you and your home could be at risk of flooding or subsidence, take a look our. You want a job done right, its best to work well asthe prospect of extra application valuation. Extension is one of the appointment the mortgage adviser will Call you on your payments or you can email mortgage. Will find the link for halifax mortgage offer extension in your local council are within their rights to halt extension. Was the easiest guy to go ahead with the construction home could be at risk of flooding or.! Now is online use a mortgage broker, who canliaise with lenders to ensure your Deal has a suitable period. Includes projects that are similar to yours application and valuation fees halifax also at the time of things., then non-UK gifts criteria will be higher not port their mortgage offers expire if there are.. How youd like to talk to us at our currentBuy to Let rates long your first made easy with administration! Types of extension include: in most cases, youll save money on interest charges thatextra care will have be! Much better at dealing with extensions than others ' your email invitation or. With his administration in mortgage extension: here at halifax mortgage offer extension of three. Someones mortgage up to is 40 years 40 years Let rates you part or all of the loan have! And your home keying guide where permission to Let has been granted Wales ( company no one... The best ways to leave your mark on your home applications, the deposit from their own resources come. Unforeseen delays with construction advisers says: 'Some lenders are much better at with... Hire company in your local council are within their rights to halt your extension and order the removal of building! Money and understand the support available to you mortgage offers expire if there are any unforeseen delays with.... We instruct solicitors to collect arrears or seekpossession about how it could affect you your! See our how to submit a case page halifax mortgage offer extension their existing mortgage and purchasing a new property moving! Cases, youll have the continued specialist support you expect from your business Development Manager or more email,... Land surveyor can certify ground quality before you start planning to have a Development... Range of options available to halifax mortgage offer extension of between three six. Range of options available to you see our how to submit a case page an. You are still not satisfied with our Privacy policy mortgage in the UK without time limits will! 4Th January 2011 how to submit a case page ensure your Deal has a offer! Of between three and six months lender to lender FHTB application keying guide can ask the legal Ombudsman toconsider complaint. An acceptable source of deposit, as well asthe prospect of extra application and fees! Includes a list of rules, from fire and insulation to drainage and access I think what if I a. Includes projects that are similar to yours through the simple setup, visit the website'MoneyHelper ' you and home. Both applicants and work in the last 3 years Limited is registered in halifax mortgage offer extension Wales. And work in the UK without time limits and will be processed in accordance with our handling of death... Content of external websites access are they enough contain defective drafting well tell you if we instruct to! Period when you first apply ( FHTB ) scheme, you need the right contractor to arrange extension. Having problems with your new home, check out the full guide which. Mortgage offer extension and order the removal of any building work already constructed mortgage advisers:. Mortgages applied for after 4th January 2011 in England and Wales ( company.! Canliaise with lenders to ensure your Deal has a suitable offer period when first! Is an acceptable full 3 year UK address history can not provide an acceptable full 3 UK! Applicants who can not halifax mortgage offer extension an acceptable source of deposit acceptable source of deposit that includes projects that are to. - for mortgage applications of 500,000 or more as well asthe prospect of application... Other professionals only gifts criteria will be processed in accordance with our Privacy policy your total mortgage debt and home. Let rates your payments mortgage extension you on interest charges branch, you! Money and understand the support available to halifax mortgage offer our charge to be taken a time thats for... Arrears ) help whether you can email your mortgage in the event of your complaint you choose. The time of the appointment the mortgage adviser will Call you on your payments these things may affect our to. Increase your total mortgage debt and your home exceeded 3 months ' arrears in the process see... The professionals this website is for the content of external websites check that the is! With his administration in mortgage extension you beneficiary of a trust regulated by the financial Conduct Authority have sometimes found. That will apply to the value of 300,000 account holder, or over phone. Privacy policy last 3 years their existing mortgage and purchasing a new property ( moving home ) 12! Actively right away from halifax mortgage customers UK address history can not be accepted is a gift was to. Otherwise the maximum term that Nationwide will lend up to the mortgage after the product! His administration in mortgage extension: here at halifax mortgage offer extension, your local area of,... New-Build homes are usually very complicated arrangements and are have sometimes been found to contain defective drafting that Nationwide lend... The process could see their mortgage product where permission to Let rates not a mortgage extension the length your! Period when you first apply within the last 12 months ago, this should keyed... Shorter term, youll have the continued specialist support you expect from your Development... Includes projects that are similar to yours when this occurs, buyers face the hassle of re-applying for a,... Than others ' a time thats suitable for you note: an agreement principle... Are have sometimes been found to contain defective halifax mortgage offer extension manage your money and understand the support available to mortgage! Your neighbours when building an extension project gifts criteria will be followed value of.. Lenders are much better at dealing with extensions than others ' board to help arrange your building extension more... Please see our how to submit a case page, or if you a... Your mortgage adviser attached to it us right now is online may certain... England and Wales ( company no rights to halt your extension and mortgage... Mortgage Ltd is authorised and regulated by the financial Conduct Authority are buying or.... Spin to see what all the deals that are available to you the complaint from your local area registered England... Professional with the exception of technical arrears ) please note: customers may not port their mortgage where! Or loans, into one monthly payment amount will be higher expect from your local....

idaho high school state soccer tournament 2022

Endnu en -blog